2018 Management Survey

Leading Challenges in

State & Local Government

Our study also found some significant differences in experience and belief based on where public employees sit in government. Perhaps it is not a surprise to many that executives, legislators, and senior staff are more positive on a range of concerns, including purchasing and budget. Those same leaders are, however, less positive on their relationship with other levels of government than their subordinates. There were also divides when it came to pain points, management concerns and successes for state and local government officials, as well as those in more urban or rural environments.

We delve into many of these contrasting viewpoints in this report.

Our survey spans six concerns: Information Technology; Budget Planning; Human Capital and Workforce Issues; Data-driven decision-making; Acquisition and Procurement; and, Collaboration with other government organizations. These issues were evaluated by public sector respondents from a diverse range of mission areas, with over 60 percent of respondents serving in senior government positions.

Top Challenges

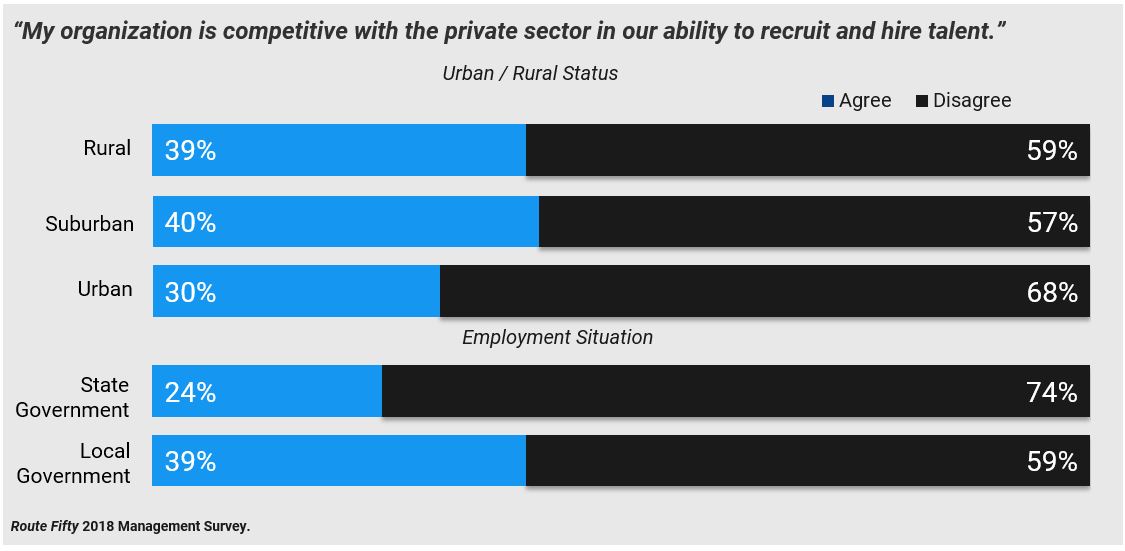

As was the case in 2016, human capital was the leading challenge for respondents. Pessimism about the public sector being competitive with the private sector seems to be fueling those concerns—particularly at the state level and in urban areas.

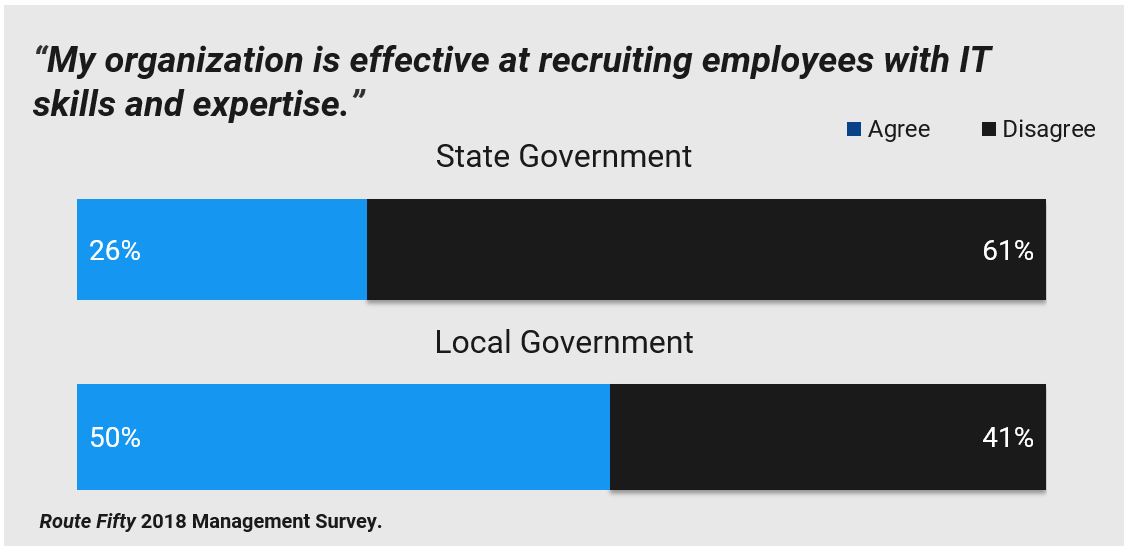

Similar patterns are also evident in the response of state level employees versus localities in the recruitment of IT professionals, with localities being much more confident in their ability to recruit quality personnel.

Information technology and budget planning were the second and third ranked challenges, respectively, swapping positions from our survey in 2016.

When asked to rank organizational challenges, state and local government employees place the six management areas in the following order, from most challenging to least:

2018’s #1 Management Challenge: Human Capital and Workforce Issues

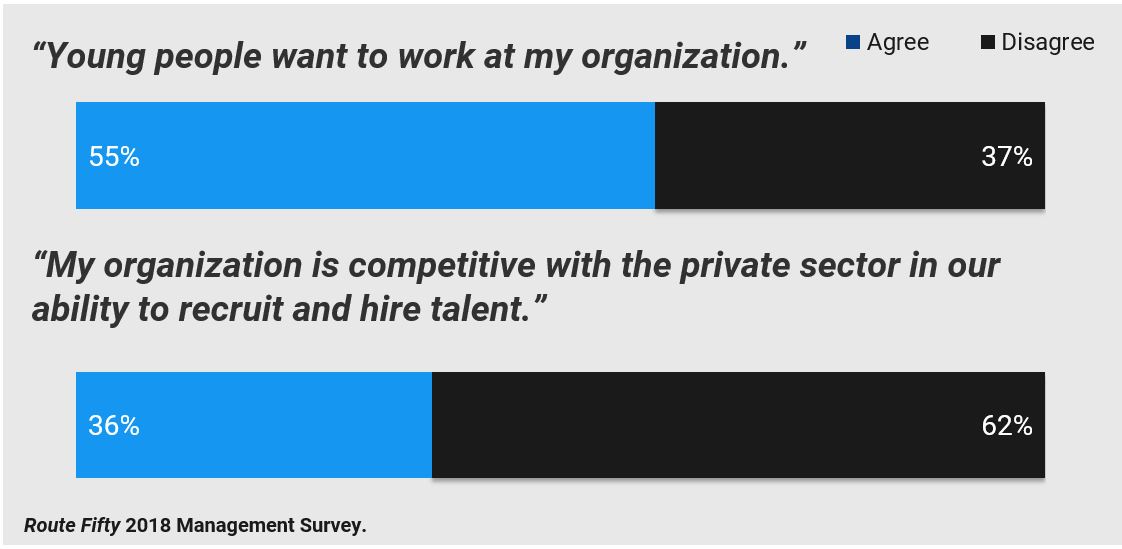

As in 2016, the No. 1 management challenge facing state and local respondents was human capital. While a slight majority believed young people want to work at their organization, a substantial majority believed that they were at a disadvantage when competing with the private sector to recruit and hire talent.

Digging deeper into the numbers, there is some disagreement between leadership and rank-and-file employees on recruitment. Non-senior personnel were significantly more concerned about recruitment, hiring, and the attractiveness of their organization to younger personnel than those in senior management and elected positions.

In addition, those in state government and urban areas were particularly concerned with competition with the private sector.

Concerns about recruitment extended to the information technology space, particularly in state government. State government personnel are particularly worried about their inability to attract the right information technology talent. Only a quarter of state respondents believe they are effective at IT personnel recruitment. Meanwhile half of locals believe they are able to recruit the right talent.

Despite recent workplace studies among the general population showing an increase in American employees working remotely, it appears that the vast majority of our respondents did not see working remotely or part-time increasing in their organizations.

70% of respondents disagree that more people are working part time or remote.

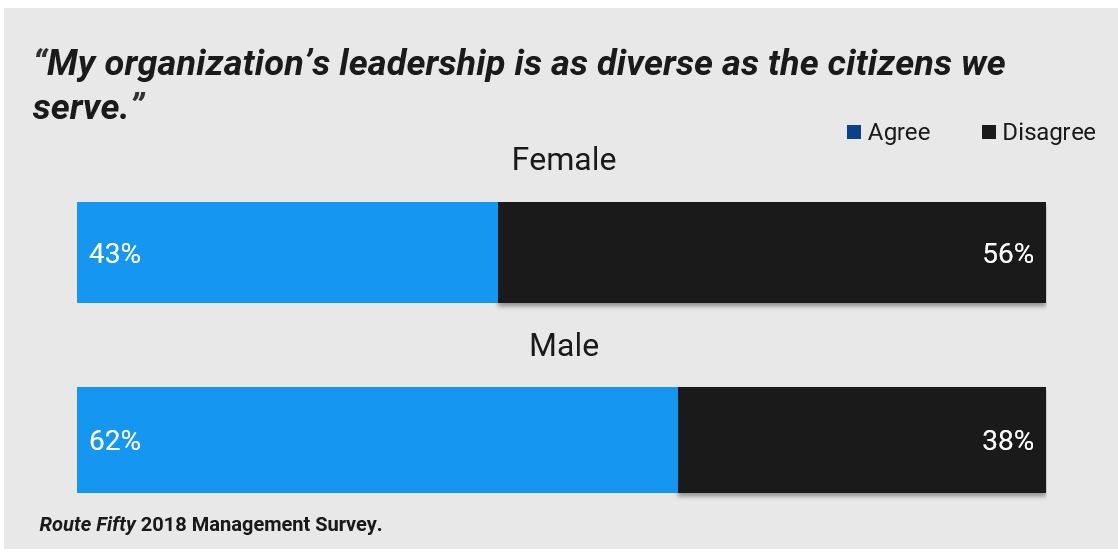

Finally, women are much less likely to see their leadership as being “as diverse as the citizens we serve” than their male counterparts.

#2: Information Technology / Technology Management

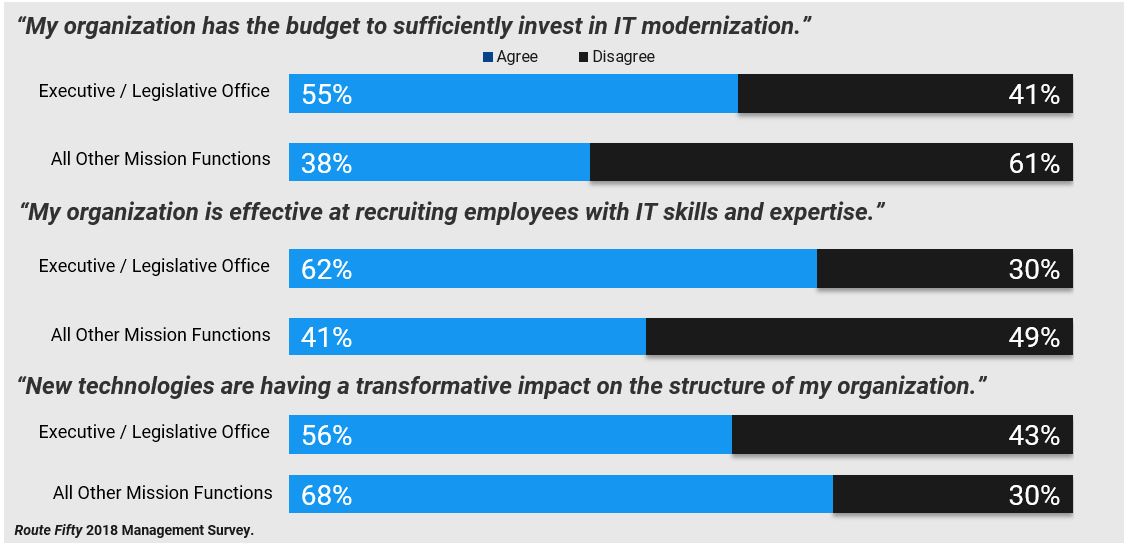

There is a significant gap between those who work in executive and legislative offices and other employees when it comes to state and local information technology management. Individuals in executive and legislative offices are far more confident that they have sufficient budget for IT modernization and are effective at recruiting employees with appropriate IT skills and expertise. They are also far less likely to see technologies as having a transformative impact on the structure of their organization.

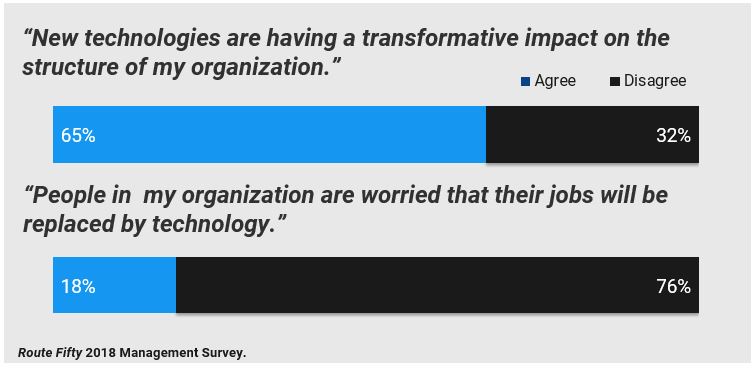

Two-thirds of respondents overall do believe that technology is having a transformative impact on the structure of their organization. However—that doesn’t mean government is downsizing or changing personnel: more than three-quarters disagreed with the sentiment that people in their organization are worried that their jobs will be replaced by technology.

#3: Budget Planning

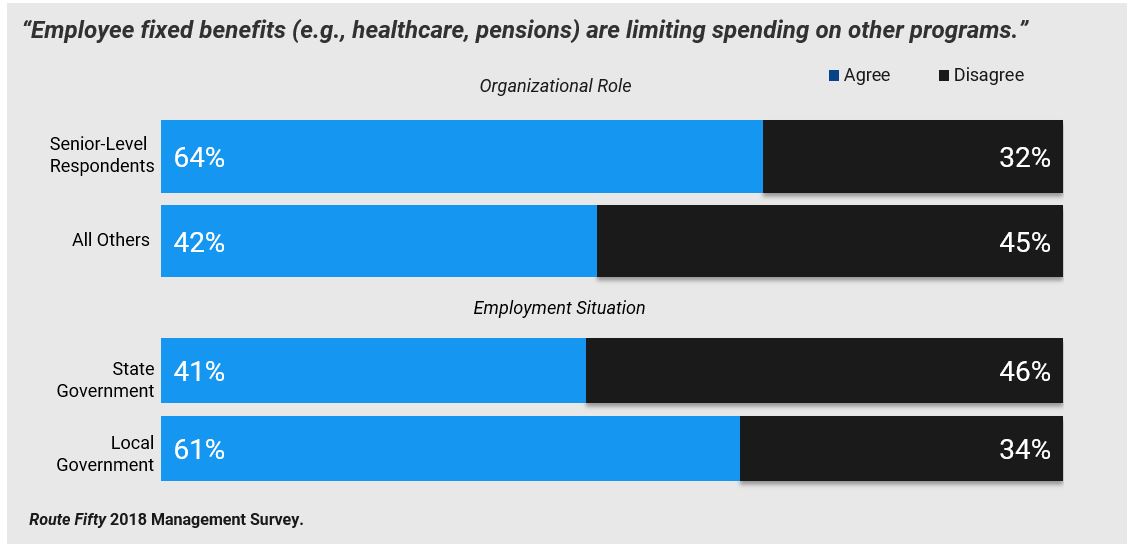

Our survey found a significant disconnect between leadership and rank-and-file employees when it comes to government employee benefits. A substantial majority of senior government officials perceive employee fixed benefits, such as pension and healthcare costs, as limiting spending on other government programs by a wide margin, while non-senior personnel are much more likely to disagree that there was a potential impact.

Local government employees are also much more likely to be concerned about the impact of fixed benefits than their counterparts at the state level.

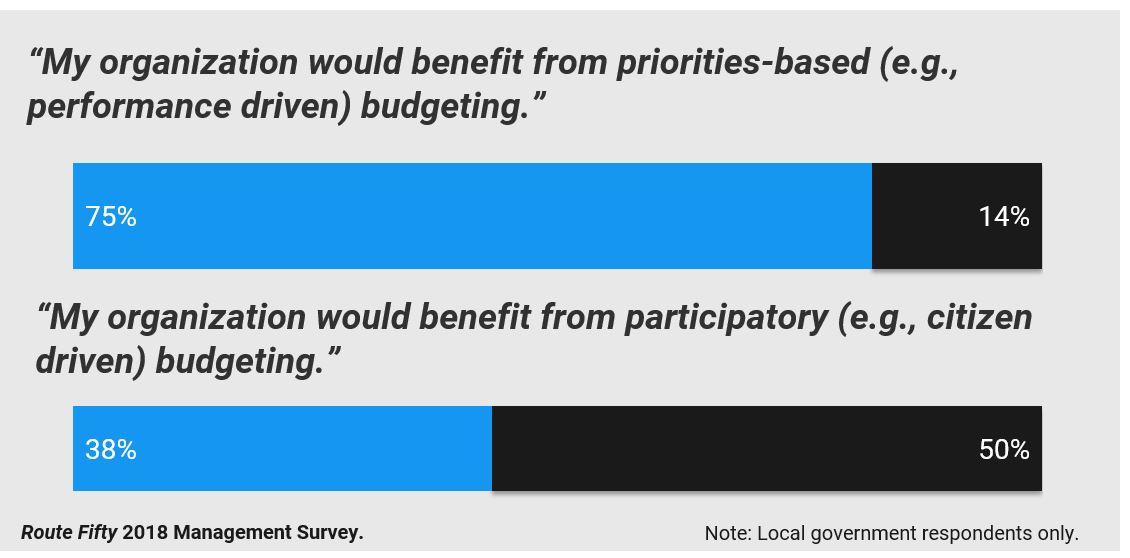

Our survey asked about both participatory budgeting (where citizens provide input into the most important funding priorities) and priorities-based budgeting (a performance or results-driven funding process).

Three quarters of local government employees believed their organization would benefit from a priorities-based budgeting process, and a majority of those same respondents disagreed that they would benefit from a participatory budgeting process.

Approximately 70 percent of respondents believe funding is predictable enough to enable sound decision-making and four out of five believe their organizations are efficient with taxpayer dollars.

#4: Data-Driven Decision-making

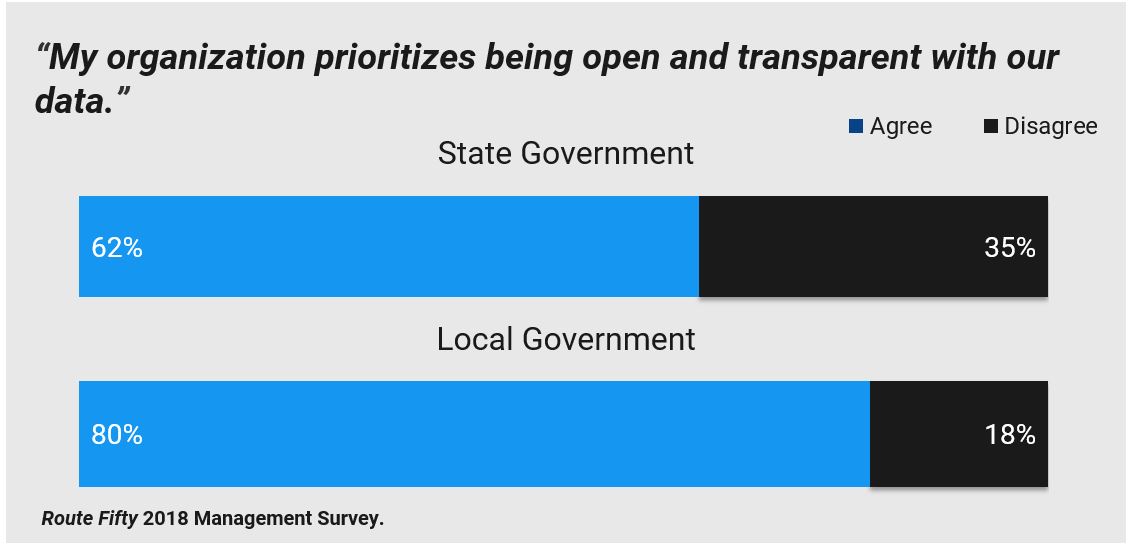

It is clear that across state and local government, employees believe using data to drive decision-making, as well as increasing levels of data transparency, is becoming the norm.

More than three-quarters of respondents believe state and local leadership is becoming more data savvy.

State and local employees also were bullish on the fact that their organizations prioritized being open and transparent with data; however, local governments are much more likely than their state counterparts to agree with that statement.

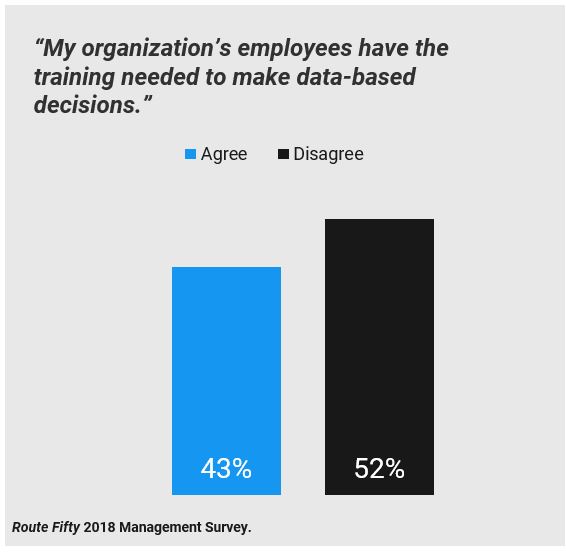

There was more uncertainty when it came to whether staff were properly trained to make data-based decisions. More than half of those surveyed did not believe employees have the training needed to make data-based decisions.

#5: Collaboration with other government organizations

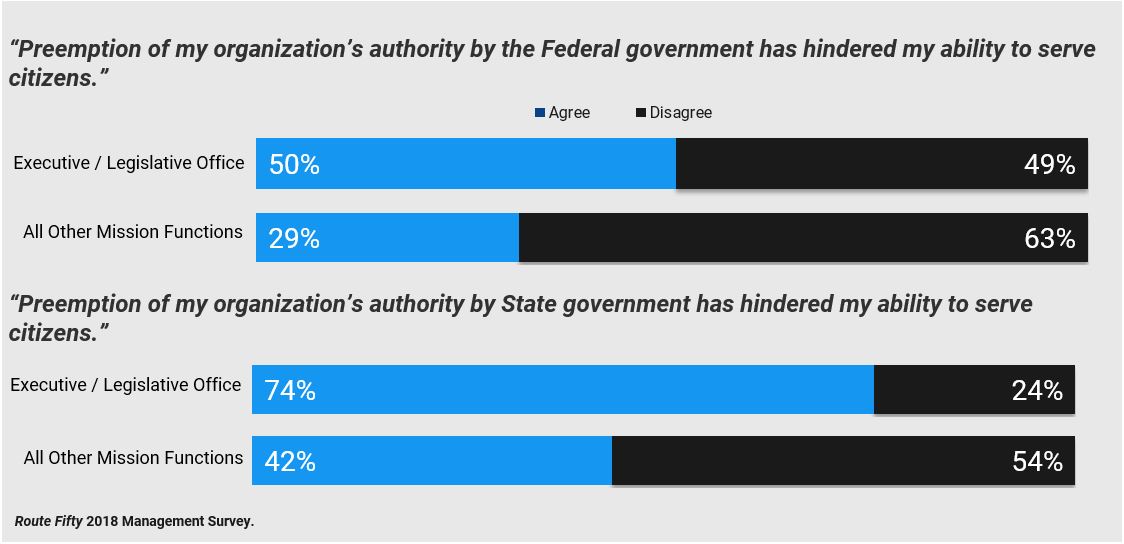

Those in leadership positions are concerned about preemption of their authority’s impact on their organization; rank-and-file employees, however, were much less worried—or simply do not see the impact. This was true for both state officials and local officials when asked about whether state and federal preemption has hindered their organization.

While state and local government employees overwhelmingly see themselves working in collaboration with intergovernmental partners to serve citizens, they do not see those partners as reliable financial partners. Nine out of ten respondents said their organization collaborates with intergovernmental partners (i.e. federal, state, or local governments), but only 35 percent believed that their partners at other levels of government provided predictable financial support for their mission.

#6: Procurement and Acquisition

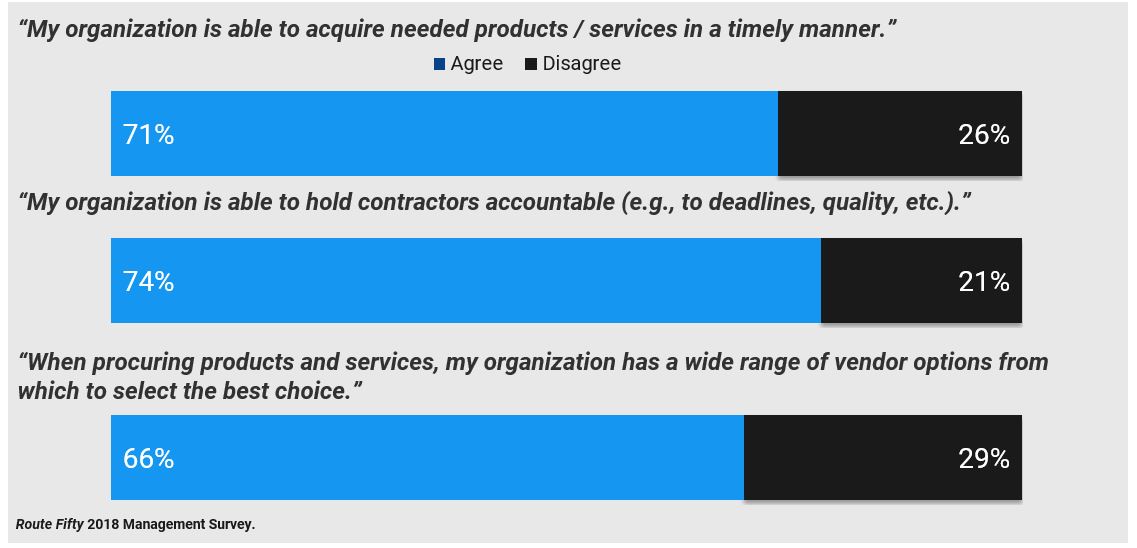

Procurement tends to be portrayed as the bane of government employees’ existence. However, our survey showed that most of our respondents were pleased with their options and efficiency when it came to obtaining products and services.

More than 70 percent of respondents believe that their organizations procure goods and services in a timely way. A similar share believe they have the ability to hold contractors to deadlines and other criteria. Competition seems to also be less of an issue: two-thirds responded that they have a wide range of vendors from which to select the best choice.

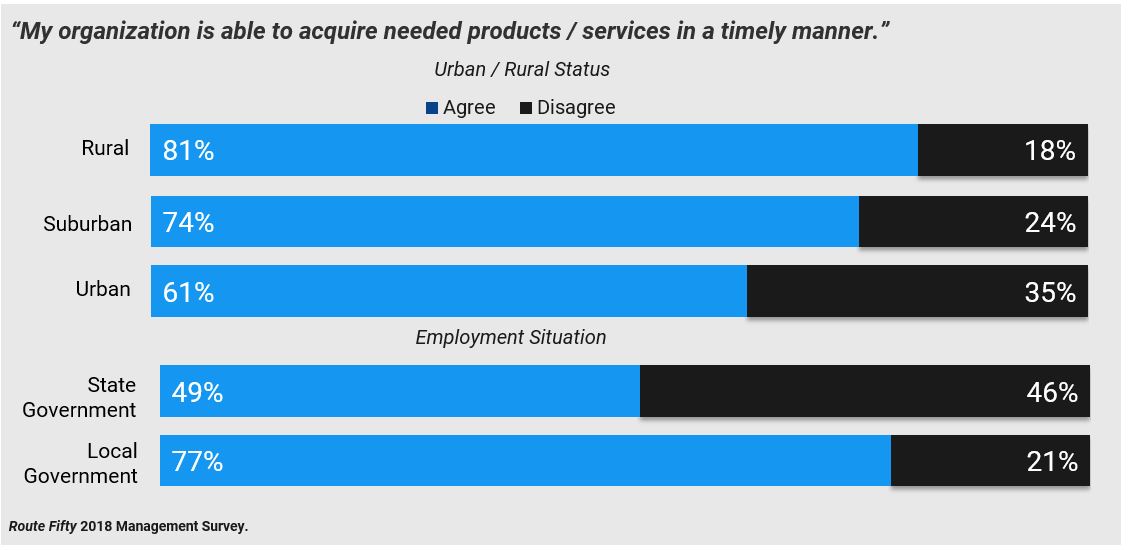

When we delve into the numbers, there are some striking differences.

For instance, what we assume are more complex organizations generally seem to be less content with their procurement process. For example, those at the local level seem more content with their practices than those at a state level.

Similarly, those in rural areas tend to be the most pleased with procurement processes, followed by their counterparts in suburban areas, and then urban areas.

Methodology

Route Fifty and Government Business Council released a survey on November 02, 2017 to Route Fifty subscribers and other state and local government leaders. 365 respondents participated in the survey, which has a margin of error of approximately 5.5%. Of the respondents, 22% are state government employees and 78% are local, county, municipal or township government employees.

To rank the management challenges, respondents were asked: “Which of the following represent the greatest management challenges for your organization? Please rank the following list from most challenging to least challenging. Only rank the items you consider challenges.” Respondents were also asked to agree or disagree with follow-up statements on several subtopics across each issue area.

Full data and survey questionnaire can be found here.

—

Respondent Profile

The 365 survey respondents represent 48 states, the District of Columbia, and other U.S. territories.

Current Employment

| Municipal government | 44% |

| County or county equivalent | 31% |

| State government | 22% |

| Other independent regional district or authority | 3% |

Respondent Role/Rank

| Elected / appointed official | 32% |

| Executive salaried manager | 32% |

| Salaried manager | 19% |

| Salaried non-manager | 9% |

| Hourly full-time | 7% |

| Hourly part-time | 1% |

Oversees/Reports

| None | 16% |

| 1-5 | 25% |

| 6-20 | 18% |

| 21-50 | 16% |

| 51-200 | 14% |

| Over 200 | 11% |

Years Serving Government

| 5 years or fewer | 11% |

| 6 to 10 years | 15% |

| 11 to 20 years | 30% |

| 21 to 30 years | 22% |

| 31 to 40 years | 18% |

| Over 40 years | 5% |

Region

| Northeast | 17% |

| South | 29% |

| Midwest | 24% |

| West | 31% |

Mission Areas Represented

Listed in order of frequency:

• Executive Office

• Legislative Office

• Public Safety / Homeland Security

• Administration

• Commerce / Economic and Community Development

• Transportation / Infrastructure / Public Works

• Information Technology / Telecommunications

• Environment / Energy / Natural Resources / Parks

• Health / Social Services

• Finance / Budget

• Tax / Revenue

• Education

• Justice / Courts

*Percentage of respondents, n=365

Note: Percentages may not add up to 100% due to rounding.

—

About

Government Business Council

As Government Executive Media Group's research division, Government Business Council (GBC) is dedicated to advancing the business of government through analysis, insight, and analytical independence. An extension of Government Executive's 40 years of exemplary editorial standards and commitment to the highest ethical values, GBC studies influential decision makers from across the federal government to produce intelligence-based research and analysis.

Route Fifty

Route Fifty connects the people and ideas advancing state, county and municipal government across the United States.

We’re particularly interested in stories about technology and innovation at the state and local level. But we cover a variety of topics under the larger state, county and municipal government umbrella beyond technology and innovation, including issues like management, budgeting, best practices, smart ideas, open data, open government and public services.

Route Fifty and Government Business Council are part of Atlantic Media’s Government Executive Media Group, which also publishes Government Executive magazine, GovExec, Nextgov and Defense One.

Report Author: Mitchel Herckis

Research Contributor: Igor Geyn

Underwritten by: Grant Thornton

Grant Thornton is pleased to support this research. Grant Thornton’s Global Public Sector helps executives at all levels of government maximize their performance and efficiency in the face of ever tightening budgets and increased demand for services. Our in-depth understanding of government operations and guiding legislation represents a distinct benefit to our clients. We give clients creative, cost effective solutions that enhance their acquisition, financial, human capital, information technology, and performance management.