IRS opens data on tax-exempt organizations

Connecting state and local government leaders

The tax agency is making the financial information from Form 990 available in machine-readable format.

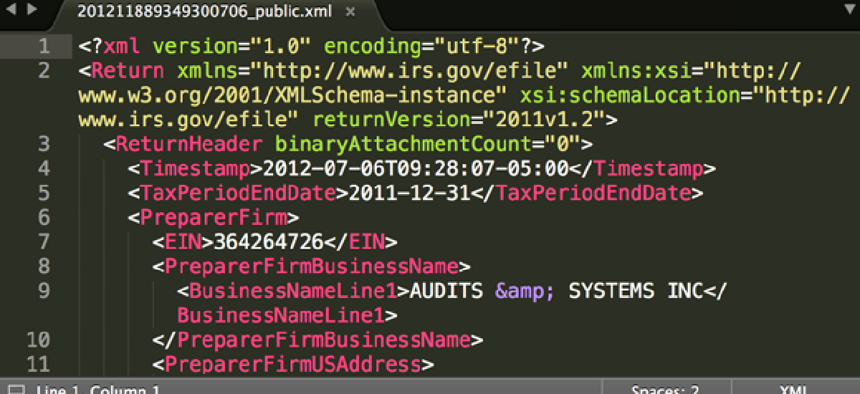

The IRS is taking a step to open financials data for non-profit organizations with its June 16 announcement that most of the 990 forms will now be available in machine-readable XML format. Up until now, the forms have only been offered as image files.

The XML files will be hosted through Amazon Web Services as an AWS Public Data Set.

"The IRS' move is a very good thing," said Hudson Hollister, executive director of the pro-transparency Data Coalition. "There is no reason why public information that the government already collects in a machine-readable format can't be published in that same format!"

Covered forms include electronically filed Form 990, Form 990-EZ and Form 990-PF from 2011 to the present, which the IRS is publishing with some personally identifiable tax-identification numbers redacted. According to the agency, more than 60 percent of Forms 990 are filed electronically.

The Sunlight Foundation lauded the move in a blog post, crediting open government advocate Carl Malamud and noting that the proactive release aligns with last year's third U.S. National Action Plan for Open Government.

The foundation welcomed the transparency that machine-readable 990 publication will likely bring to charities and other non-profit organizations.

"[J]ournalists, auditors and congressional investigators will now be able to analyze the data to look for trends and patterns, finding and flagging issues," wrote Sunlight’s Alex Howard. "It's also going to empower officials and watchdogs to track and reveal influence in the nonprofit world."

At the same time, it is far from a perfect move, Howard told FCW, GCN's sister site. The XML disclosures may be machine-readable, but they aren't easily accessible to the less-than-tech-savvy public, and it also seems as if the IRS may still be going through the superfluous process of turning electronically filed data into less-useful image files.

The IRS confirmed this to be the case. "Both paper and electronically filed 990 returns will continue to have image files made and these files will continue to be available by DVD," an IRS spokesperson told FCW.

Hollister and Howard both said that some small nonprofits will likely continue filing on paper -- and thereby not falling under the new disclosure setup -- for the foreseeable future, though they both noted the IRS could push for more electronic filing.

Howard said that by "showing that disclosures are possible in a way that uphold public interest and protect privacy," the IRS could be setting a transparency precedent for itself, other agencies and other governments.

"I don’t think it’s a one-off," he told FCW. Other agencies can look to this work as a model for redaction and proactive disclosure, he said.

Hollister said IRS could eventually follow the lead of countries such as Australia, where nonprofits can report to multiple government organizations through a single process.

"In the longer term, the transformation of the IRS' nonprofit reporting regime into open data will be aligned with other nonprofit reporting regimes, saving compliance time and money and increasing transparency," Hollister said. “For instance, under the DATA Act the Department of Health and Human Services is testing an open data format for grantees' (including nonprofits') grant reports. If the IRS and HHS aligned the open data formats of nonprofit tax reporting and nonprofit grant reporting, respectively, grantees would be able to comply with both regimes using the same software package."

NEXT STORY: Heatmaps offer cities new insights into SeeClickFix data