How Exposed Is Your State to Trade Tensions?

The Chinese delegation sits down with U.S. officials to talk trade in May in Washington, D.C. Courtesy Congressman Bill Pascrell's Office via AP

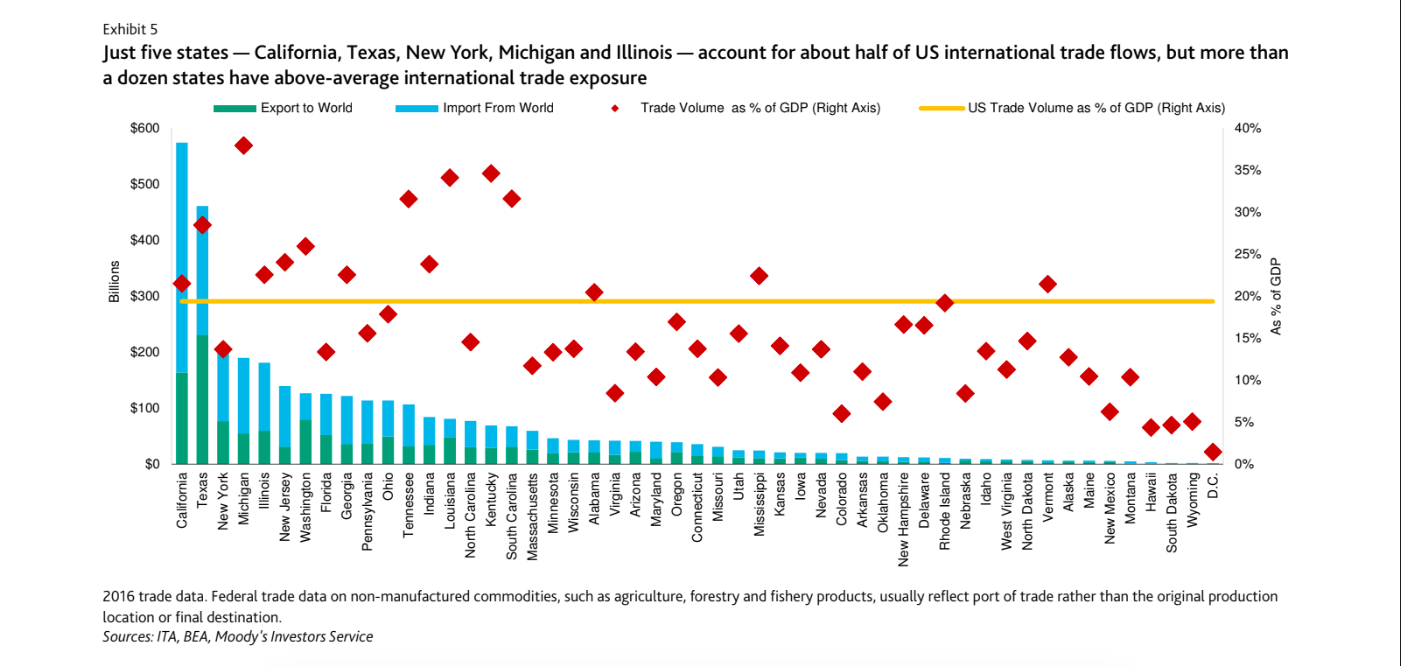

More than a dozen states have above-average international trade exposure, per a new Moody’s report.

Implementation of U.S.-China tariffs or withdrawal from the North American Free Trade Agreement would have bigger economic effects on some states compared to the more limited impacts of other recent trade decisions, a new Moody’s Investors Service report found.

U.S. talks with Mexico and Canada to renegotiate NAFTA are ongoing, although it remains unclear exactly when a new deal might be inked. President Donald Trump has said reducing the trade deficit with China is a major priority, with both sides at various points raising the threat of tariffs on imports.

The impacts of the U.S. pulling out of the Trans-Pacific Partnership after Trump became president and imposing duties on washing machines, solar panels, steel and aluminum earlier this year were short lived.

If the ongoing negotiations tank, however, the report found that states with the greatest trade dependency on China, Canada and Mexico are at highest risk of seeing their tax revenues decline—namely Michigan, Kentucky and Louisiana.

“Most state and local governments can withstand short-lived diminished economic growth and a related slowdown in revenue growth. To the extent that severe trade disruptions lead to significant economic pressures, state and local governments with sizable reserves or flexibility to raise revenues and cut expenditures are better positioned to adapt.”

Severe trade disruptions might also hurt manufacturing hubs like Detroit and Greenville, South Carolina, as well as port cities like Laredo, Texas; Longview, Washington; and New Orleans, Moody’s found.

Over the long term, states could see their social spending and taxing capacity take a hit in the event of a “trade war.”

California, Texas and New York boast large trade volumes but also diverse economies that can weather renegotiated trade terms barring a national downturn. More than a dozen states have above-average international trade exposure, according to the report.

Michigan and Kentucky, the states with the greatest exposure, are highly concentrated in auto manufacturing and therefore dependent on access to global supply chains. Canada and Mexico account for about 70 percent of Michigan’s trade volume, which could be disrupted by NAFTA renegotiation.

Moody’s expects NAFTA will be successfully renegotiated. If not, Michigan’s gross domestic product, or GDP, and unemployment rate could be hurt for several years, the report found.

Border states tend to have higher trade dependency.

Manufacturing makes Washington, South Carolina and Tennessee more vulnerable. South Carolina in particular benefits from foreign business investment that could slow in the event of economic uncertainty.

The U.S. isn’t thought to be considering tariffs on energy because nonrenewable resources like oil are hard to replace, according to the report, but that makes agriculture a main focus of trade tensions.

More states are capable of withstanding short-term economic disruptions that in the past, and as of 2016 they collectively had a median available fund balance of 6.1 percent of revenues—up from 2.5 percent five years previous. Cities saw an increase in reserve funds from 28.1 percent to 33.9 percent during the same timeframe.

Both Louisiana and California require two-thirds of their legislatures to approve tax hikes, but the latter did just that with its sales tax and marginal personal income tax rates during the last recession—generating $8.7 billion.

Cutting spending is a third option, as only 10 percent of state spending represents fixed costs on average.

Dave Nyczepir is a News Editor at Government Executive’s Route Fifty and is based in Washington, D.C.

NEXT STORY: Banking Bill Expected to Help Lower State and Local Borrowing Costs