Washington Voters Approve Ban on Local Soda and Grocery Taxes

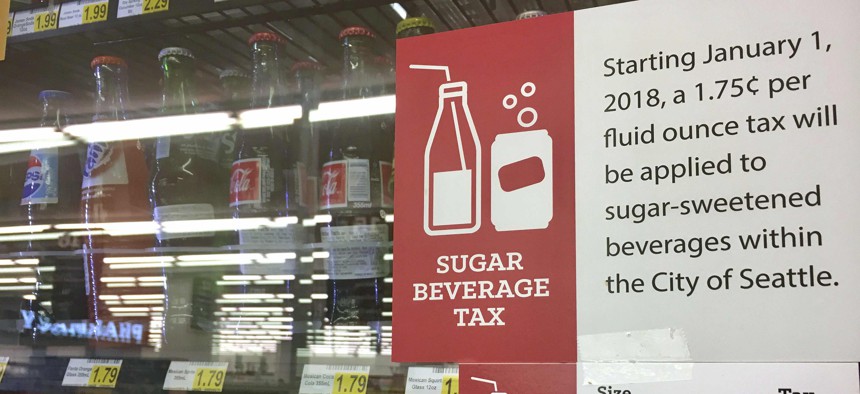

In this Sept. 24, 2018, a sign posted on a drink cooler in a store gives information about a soda tax that took effect in January, in Seattle. (AP Photo/Lisa Baumann)

Connecting state and local government leaders

The initiative drew over $20 million of support from soft drink companies and others. A similar proposal in Oregon failed.

Local governments in Washington state will be blocked from enacting new taxes on sugary drinks and other grocery items under a ballot measure there that appears to have easily passed.

Oregon voters, meanwhile, shot down a similar anti-tax proposal supported by the grocery industry.

Unofficial results in Washington on Thursday evening showed 55 percent of voters backing initiative No. 1634, and just 44.9 percent voting against it—a roughly 10 percentage point spread.

Advocates for the measure framed it as an attempt to protect consumers against taxes on grocery store items.

But the ballot initiative followed Seattle’s enactment of a tax on soda and other sugary beverages and critics said it was largely designed to keep other localities from following suit.

Soda makers like Coca-Cola Co. and PepsiCo, Inc. were top donors to the campaign committee for the measure, which drew at least $22.1 million in cash contributions, and spent about $20 million, according to campaign finance filings.

“This is a victory for all Washingtonians who came forward to put a stop to regressive taxes that place a larger share of the burden on residents least capable of paying it,” the “Yes! To Affordable Groceries” campaign supporting the measure said in a statement.

Vic Colman managed an opposition campaign with a shoestring budget of about $33,000, according to the most recent available figures.

“We ended up being outspent 200-to-one on this,” he said.

“We're at 45 percent,” he added, “With that funding disparity we actually did a pretty good job getting our message out.”

The outcome was the opposite for a similar business-backed measure in Oregon that would have imposed new restrictions on both state and local taxes related to the grocery business. Measure 103, as it was known, was rejected by about 57 percent of voters.

It would have amended Oregon’s state constitution to prohibit the state and local governments there from taxing the sale, purchase or distribution of groceries. The measure was drafted in a way that would’ve protected grocers themselves from certain business levies. One of its effects would have been barring cities and the state from enacting taxes on sweetened drinks.

Top donors to the campaign included the American Beverage Association, which had ponied up $3.2 million as of Oct. 31, as well as grocers like Albertsons Safeway and Kroger, which chipped in $785,917 and $770,917 respectively. Total contributions to the main campaign committee backing the measure were around $5.9 million, the latest campaign finance records show.

The main group opposing the measure raised about $3.3 million, with billionaire former New York City mayor Michael Bloomberg contributing about $2.1 million in late October. Bloomberg has a history of supporting the taxation of sweetened beverages.

In Washington, the measure restricting taxes had only failed to win over voters in three counties as of Thursday—the island county of San Juan, Jefferson County, on the Olympic Peninsula, where Port Townsend is located, and King County, which is home to Seattle.

Seattle is the only city in Washington state with a tax on soda, and no other local governments were openly considering such a tax in the run-up to the election. In King County, 54.9 percent of the electorate opposed the ballot measure, results posted online by the state showed.

Because Washington state residents vote by mail, there’s a lag after Election Day tallying total votes and results continued to come into sharper focus throughout the day on Thursday.

Washington state law already includes sales tax exemptions for many grocery items.

But the ballot measure will prevent local governments from imposing new taxes on the goods—including their manufacture, distribution and sale. It would also prohibit localities from raising existing grocery taxes. Alcohol, and marijuana and tobacco products are not covered.

Seattle’s soda tax will be allowed to stand under the measure, but could not be raised or expanded in scope going forward.

A handful of cities around the U.S., including Boulder, Colorado and Philadelphia have in recent years taxed sugary drinks, which have been tied to obesity and other health risks.

While the Washington state government isn’t blocked from imposing taxes on soda under the ballot measure, Colman wasn’t optimistic that lawmakers would take up the policy.

“The soda industry has been pretty strong in defending any state level sugary drink taxes,” he said. “They know how to hire a lot of suits, a lot of lobbyists,” he added. “I’m not so sure that that is in the cards.”

This post was updated Thursday evening with the latest vote tally from Washington.

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: Effort to Kneecap Gas Tax Revenue Fails in California