A Nationwide $15 Minimum Wage Could Have Mixed Results

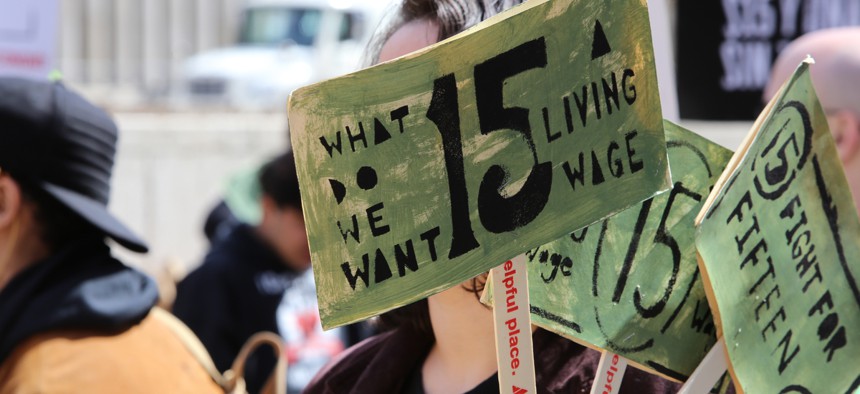

A protest in New York in support of a $15 minimum wage. katz/Shutterstock

A new report says that a $15 federal minimum wage could help lift low-wage workers out of poverty, but also cause job losses.

Raising the federal minimum wage to $15 an hour—a priority for House Democrats—could result in millions of workers making more money and lift 1.3 million families out of poverty, but could also cause the loss of around 1.3 million jobs, a new report found this week.

The Congressional Budget Office released the evaluation Monday detailing the anticipated results of a $15 federal minimum wage. The nonpartisan office estimated that there is a two-thirds chance that the net loss in jobs would be between zero and 3.7 million, resulting in the median estimate of 1.3 million.

They also concluded that such an increase in the minimum wage would lift the same number of families out of poverty, and would boost the wages of 17 million people currently making less than $15 per hour, as well as an additional 10 million people currently making just over $15 per hour.

The report was intended to evaluate the Raise the Wage Act, a bill pushed by House Democrats that would gradually transition the nation from a $7.25 to a $15 minimum wage by 2025. The issue has been brought to prominence by progressives like Bernie Sanders and Alexandria Ocasio-Cortez, but has only recently gained enough support throughout the party to garner a floor vote, which is expected to take place within a few weeks.

The conclusions of the report were met with strong reactions from both Democratic and Republican legislators. Democrats argued that the findings show the robust benefits of a higher minimum wage, while Republicans contended that the findings mean a higher wage is untenable.

“The Congressional Budget Office’s report comes to a clear conclusion: The benefits of the Raise the Wage Act for America’s workers far outweigh any potential costs,” reads a statement from Rep. Bobby Scott, a Democrat who has guided the bill as the chairman of the House Education and Labor Committee. “Even taking the CBO’s imprecise projections of employment effects at face value, the Raise the Wage Act would benefit up to 95 percent of America’s low-wage workers.”

But House Budget Committee Ranking Member Steve Womack, the Republican who requested CBO’s analysis, took a different view. “This report confirms what we already knew...a 107-percent increase on the minimum wage could result in up to 3.7 million lost jobs—jobs hardworking Americans rely on to feed their families and pay their bills, jobs communities need to fuel their local economies, and jobs essential to strengthening our nation’s financial future,” Womack said in a statement.

The report also looked at the implications of a $10 and $12 minimum wage. The federal wage floor is currently set at $7.25 an hour, although many states and some cities have higher requirements.

The $12 option would increase wages for 5 million workers making less than that, and another 6 million who make slightly more than that. That option would also result in a two-thirds chance of a net loss of jobs between zero and 0.8 million, with a median of 0.3 million The number of families below the federal poverty level could fall by 0.4 million. With the $10 option, 1.5 million workers making less would see wage gains, along with 2 million workers who currently make slightly more than $10. That option would have little effect on employment, and no effect on the number of families in poverty, the CBO report found.

The report notes that low-wage workers, particularly teenagers, adults who lack high school diplomas, and women, would be disproportionately affected by both positive and negative changes resulting from a $15 minimum wage.

How a federal change in minimum wage would impact states varies greatly based on the number of low-wage workers in the state and the minimum wage already set there.

Workers in California, Illinois, Massachusetts, New Jersey, Maryland, and D.C., where minimum wage is already being phased to $15 before 2025, would see virtually no impact with the change. States like Colorado, Missouri, New Mexico, Oregon, and Washington, which are slated to set minimum wage rates of $12 to $13.50 by 2025, would see a minimal effect. States that essentially follow the federal requirement because they have no law or set it below that rate (like Georgia and Wyoming, which set their state at $5.15) would likely see significant wage boosts for low-wage workers, who would then stand a greater chance of layoffs.

This year in particular has seen a rush of states and cities looking to increase their minimum wage. The federal standard is now surpassed in 29 states and D.C., with many states indexing their numbers to inflation. Cities with particularly high cost of living have even surpassed the $15 proposal; San Francisco made their minimum wage $15.59 as of July 1, 2019, and has set that number to be annually adjusted to inflation.

But as dozens of city and county governments in recent years voted to raise their local minimum wage ordinances, many have been slapped down by state lawmakers. So far, 27 states have passed preemption laws prohibiting localities from replacing state standards with their own. Local governments have called the practice unfair, citing the higher cost of living that exists in cities compared to rural areas of states.

Much of the rationale for a higher wage also rests on the fact that while the federal minimum wage has risen in nominal terms over the years, these increases have been eroded by inflation. As the CBO report notes, the most recent federal change, from $5.15 in 2007 to $7.25 in 2009, happened during two periods of pronounced erosion.

What effect the report will have on a congressional vote remains uncertain. Some economists have criticized the CBO’s methods. Heidi Shierholz, of the left-leaning Economic Policy Institute, noted that the way the findings were phrased was misleading. “Employment decline as a result of a minimum wage increase doesn’t necessarily mean any worker is actually worse off,” she wrote in a statement. Shierholz noted that each quarter, more than 20% of low-wage workers start or leave their jobs, so even if an employment decline happens, those workers could still earn more.

“Consider the case of someone who now works a full-time job at $7.25 an hour for ten months a year, but can only find work for eight months when the minimum wage is increased to $15. This worker experiences a strong negative employment impact of the minimum wage increase, but actually has substantially higher annual earnings,” Shierholz said.

Even so, other economists, including those from the right-leaning Employment Policies Institute, noted that the CBO report should “have [Democrats] terrified” about voting for a minimum wage hike. The CBO itself, however, stressed that the findings laid out within the report are “uncertain” and “depend on, among other things, how employment responds to higher wages, how much wages grow, and how long workers who lost their jobs would remain jobless.”

Emma Coleman is the assistant editor for Route Fifty.

NEXT STORY: State Savings Policies Evolve Amid a Decade of Economic Growth