Can pensions help address growing wealth inequality?

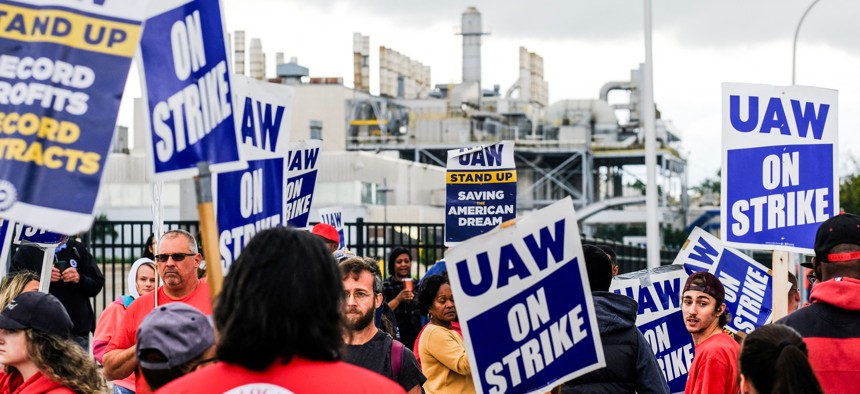

The United Auto Workers union is demanding the restoration to traditional pensions, among other things. Matthew Hatcher/AFP via Getty Images

A new report finds that pensions have significant impacts on household wealth, increasing net worth across race, gender and educational attainment.

President Joe Biden on Tuesday joined a picket line with striking autoworkers in Michigan, backing their call for a 40% pay raise. But also among the demands made by the United Auto Workers union is for the restoration of traditional pensions.

Pensions are rare outside of the auto industry and the public sector these days. Indeed, from 1980 through 2008, participants in pension plans fell from 38% to 20% of the U.S. workforce, while employees covered by defined-contribution plans like 401(k)s jumped from 8% to 31%, according to the Bureau of Labor Statistics.

That decline in pensions and increase in 401(k) plans, several Federal Reserve economists have suggested over the past four years, is a contributing factor in the rise of wealth inequality in the U.S. Today, according to the Federal Reserve Bank of St. Louis, the top 10% of households by wealth had $6.8 million on average, and, as a group, held 69% of total household wealth. Meanwhile, the bottom 50% of households by wealth had $48,000 on average, and held only 2.4% of total household wealth.

Now a new report from the National Institute on Retirement Security and the UC Berkeley Labor Center lends support to the Federal Reserve’s assertions. It looks at the impacts of public sector defined-benefit pensions on race, gender and educational attainment.

“While researchers noted that pension plans tend to lessen the degree of inequality in the U.S., this report delivers tangible data,” Dan Doonan, executive director at the National Institute on Retirement Security, said during a webinar last week.

The study reports significant impacts on a family’s wealth. The “value of pension income in household wealth boosts the typical (median) net worth of older families by 36%,” according to the report. The impact for older Black families is even more substantial: Pensions increase their median net worth by 86%, with public pensions providing more than half of this impact. And for older Latino families that historically have been underrepresented in the public sector, pension benefits increase their median wealth by 32.4 percent, with “two-thirds of the boost coming from private pensions.”

Based on data analyses from the U.S. Census Bureau and the U.S. Bureau of Labor Statistics, the report also finds that pension plans have a notable impact on women and those without a four-year college degree.

Public pension income is distributed more equally by gender than private pension and 401(k) income, which the study’s author Nari Rhee, director of the Retirement Security Program at the UC Berkeley Labor Center, said reflects different employment patterns by women. In other words, women tend to leave the workforce to raise children and take care of seniors in their family. More than half of public pension wealth is held by women, compared to 38.2% of private pension wealth and 38.6% of 401(k)/IRA assets.

In addition, retirees fare better economically with a pension regardless of educational attainment, with the largest improvement among those without bachelor’s degrees.

This improvement is shown when compared against the federal poverty level, or FPL. The report uses 200% of the FPL as a benchmark to assess the poverty-alleviating impact of pensions. Those with no college education, but who have a pension, were 73% more likely to be above 200% of the FPL than those with no college education and no pension.

“The pensions reduced poverty across race, sex and educational attainment,” said Rhee during the webinar. “The anti-poverty impact was strongest for Blacks and Latinos.”

Across all retirees, a significantly larger share of those with pension income were above 200% FPL in 2018-2020 (91%) compared to retirees without pension income (60%). Retired Black women, Latino men and Black men were twice as likely to have incomes above 200 percent FPL if they had a pension.

The report is supplemented by 51 fact sheets that detail the retirement equity impact of pensions in each U.S. state and the District of Columbia. The intention, according to Rhee, is to inform policymakers’ discussions about the social equity impact of pensions.

“Pensions remain a critical component of middle class retirement security and act as a buffer against wealth inequality,” Doonan said.