By the numbers: How pandemic relief expanded affordable housing

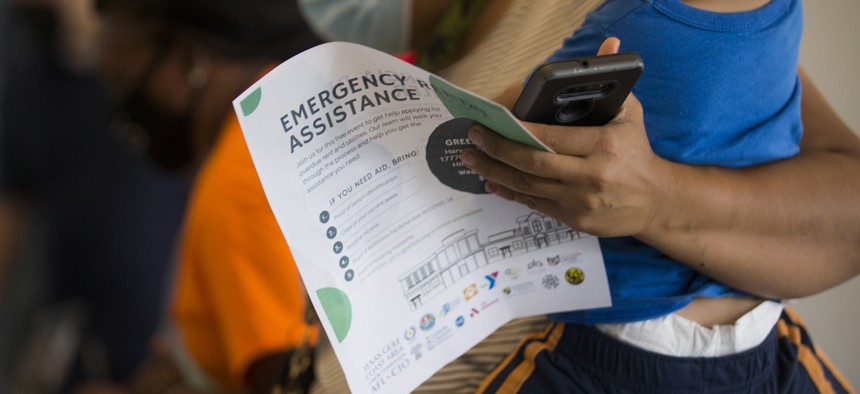

People line up to apply for help through the Houston-Harris County Emergency Rental Assistance Program in 2021. Brett Coomer/Houston Chronicle via Getty Images

The American Rescue Plan Act helped keep millions housed during the pandemic and created long-term affordable options. A new report digs into the numbers behind the initiatives.

Almost exactly one year after the COVID-19 pandemic hit, Congress passed the American Rescue Plan Act—a $1.9 trillion stimulus package meant to speed the country’s recovery from the public health emergency. But ARPA also helped communities navigate a concurrent crisis: a nationwide lack of affordable housing. A new report from the U.S. Department of Treasury breaks down how state and local governments have leveraged three federal pandemic relief programs—State and Local Fiscal Recovery Funds, or SLFRF, the Homeowner Assistance Fund and the Emergency Rental Assistance Program—to keep residents housed during the pandemic and beyond.

$63 billion for housing projects nationwide

As of the end of June, state and local governments had dedicated about $63 billion for housing through the three federal pandemic relief programs. The largest recipients of SLFRF have spent about 85% of their allocated funds, and it appears community programs have been gaining momentum as they spend the last of the cash: Total projects are up 18% since the beginning of the year, the report notes.

400,000 households avoid foreclosure

State and local governments have spent over $5.5 billion in Homeowner Assistance Funds to help nearly 400,000 households avoid foreclosure, and overall foreclosures nationwide are 13% below pre-pandemic levels. That assistance has often gone to vulnerable and minority households, with half the funding going to homeowners earning less than 50% of the area median income. Thirty-five percent of the assistance went to Black homeowners, 18% to Latino homeowners and 59% to female homeowners.

Besides mortgage payments, the program also covers other costs like homeowner’s insurance and utilities. In West Virginia, the state tailored its homeowner assistance program funds to allow recipients to use the money for critical repairs that kept houses accessible and habitable, ensuring seniors could remain in their homes as they aged. That flexibility is likely to have intergenerational benefits, the report said, as a large share of older West Virginians are raising their grandchildren.

12.3 million emergency rental payments.

The Emergency Rental Assistance Program issued more than 12.3 million household payments, saving millions of people from eviction. Of the $46 billion in federal ERA funds, more than 60% has gone to communities of color and 66% to female-headed households.

In addition to rental payments, the program helped cities and states set up eviction diversion programs. Oregon, for example, used a combination of ERA funds and SLFRF to operate its Eviction Prevention Rapid Response Program to prevent homelessness.

The end of the federal program has many communities concerned about keeping residents housed as housing costs continue to soar. That’s pushed several cities and states to build up their own emergency rental assistance programs, including in Minnesota, where the legislature passed a $50 million law that will launch such an initiative.

17,000 units of affordable housing

While SLFRF could be used for a variety of efforts—including for infrastructure projects and to help small businesses—the Treasury Department last year expanded rules for the funding to encourage communities to build long-term affordable housing projects. Governments have allocated more than $6.6 billion in SLFRF toward those projects, supporting the construction of more than 17,000 units of affordable rentals and homes. Missouri, for example, is budgeting $3 million to build 34 affordable units complete with a 4,000-square-foot community facility for supportive services and onsite staff. Lynn, Massachusetts, is using its funding to build 43 units of mixed-income housing for veterans, while Cobb County, Georgia, is budgeting for 14 affordable single-family homes.

NEXT STORY: How states can avoid a COVID relief fiscal cliff