States could struggle to cut workforce costs in next downturn

bobaa22 via Getty Images

It's a well-worn script. When states face budget challenges, they typically look to cut personnel spending first. But that might not work this time.

You're reading Route Fifty's Public Finance Update. This article was originally published by The Pew Charitable Trusts. To get the latest on state and local budgets, taxes and other financial matters, you can subscribe here to get this update in your inbox twice each month. You can find a full archive of these newsletters here.

In the face of nascent fiscal challenges, the governors of Arizona, California, Maryland, and Massachusetts recently turned to a similar strategy to bring state budgets back into balance: They have sought to spend less on state employees.

Earlier this year, Katie Hobbs of Arizona and Maura Healey of Massachusetts, both Democratic governors, responded to disappointing revenue collections by imposing limits on state hiring, though both termed their actions as something short of a “hiring freeze.” In California, where the fiscal problems appear especially severe, a June budget deal eliminated thousands of vacant positions.

In taking these actions, the governors are following a well-worn script. When states face budget challenges, one of the first things they typically do is to try to limit state head counts and personnel spending. But if more states face new budget problems—later this year or in the future—there are good reasons to doubt that this strategy will achieve the same savings it has in the past. That’s primarily because many are already allocating a significantly smaller share of their budgets toward salaries and wages.

With that in mind, state leaders should regularly update their budget-balancing playbooks to ensure that they can close budget gaps quickly—and with the least disruption possible to residents and public services.

How and Why States Cut Personnel Costs

To close shortfalls, in theory, states can rely on almost any combination of spending reductions, revenue increases, or other budget maneuvers. In practice, however, policymakers’ options are constrained. For example, states often must navigate legal restrictions and put federal funding at risk if they attempt to cut the two largest areas of general fund spending: K-12 education and Medicaid. As a result, budget cuts tend to disproportionately affect other categories of spending, such as higher education, local government aid, and the state workforce. States also raise taxes, rely on federal help, and tap rainy day funds, the savings accounts in which states deposit money in good years for use in bad ones.

But personnel cuts can be appealing because of their speed. Many budget-cutting steps require legislatures to draft, debate, and enact new spending plans, typically a months-long process. In contrast, it often simply takes an order from a governor to freeze hiring.

In Maryland, Gov. Wes Moore, a Democrat, in July ordered state agencies to delay hiring for some positions to deal with budget challenges—an action the governor could take even though legislators are not scheduled to return to session until January. Likewise, in 2020, when the COVID-19 pandemic caused sudden declines in tax revenue, 19 states imposed hiring freezes, eliminated vacant positions, or both within months of the start of the national emergency.

Because critical workers regularly leave their jobs, it is almost impossible for states to stop hiring entirely, even for a short period. In Arizona, Hobbs’ order allows agencies to replace employees who leave as long as they do not increase overall head counts. In Massachusetts, Healey exempted some categories of workers—such as public safety staff—from her order and also established a process where the central budget office could approve specific hires. How well state leaders navigate such complexities helps determine how much money hiring freezes save and to what degree they disrupt government operations.

Nor do states always stop at merely slowing hiring. The budget crises caused by the Great Recession, which ran from 2007 into 2009, led states to adopt both hiring freezes and more drastic policies to achieve personnel savings, including furloughs and layoffs. In fiscal year 2010 alone, 26 states used layoffs and 22 turned to furloughs. Policymakers often favor broad workforce cuts because they offer a way to reduce spending without singling out specific programs or services for elimination.

Why Workforce Cuts Will Be Harder in the Future

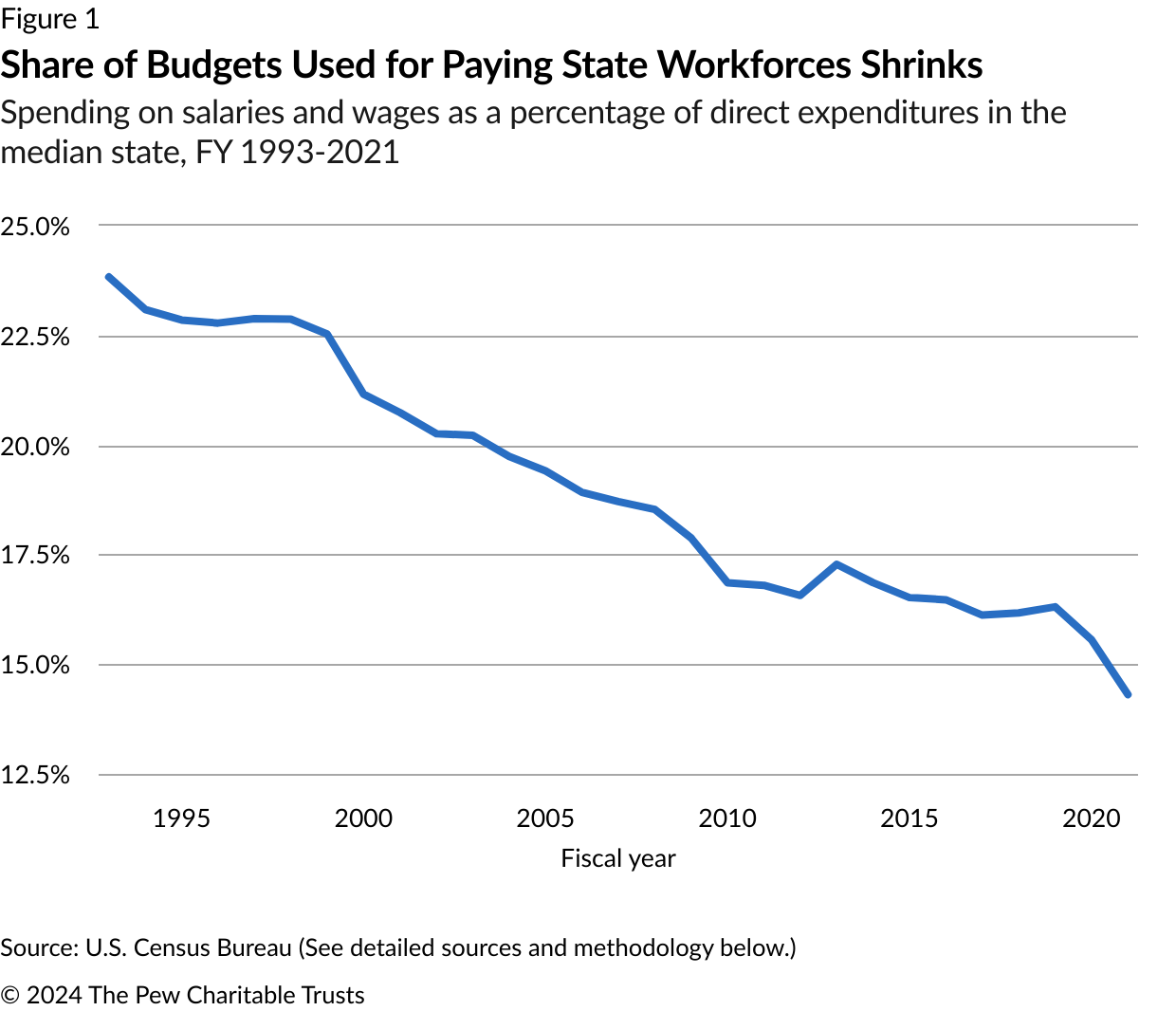

Employee compensation is a natural place to look for cuts because it is such a big part of state budgets. However, U.S. Census Bureau data shows that state spending on salaries and wages has been in long-term decline as a percentage of overall direct expenditures. (See Figure 1.) Spending in this category fell by 40% in the median state from fiscal 1993 to fiscal 2021, the most recent year for which data is available.

With states spending less on salaries and wages, cuts in this category in future downturns will be less effective at closing budget shortfalls or have to be proportionally larger to close significant budget gaps. For example, the Census Bureau data shows that in 1993 an 8.4% cut to salaries and wages would have closed a shortfall equal to 2% of direct expenditures in the median state. In 2021, though, the cut would have had to be nearly 14% to close a 2% shortfall.

A big reason that total pay for state workers has grown more slowly than other spending categories is that the size of the core state workforce nationwide has not increased appreciably in decades. Excluding education workers, Census Bureau and U.S. Bureau of Labor Statistics data shows that states employed roughly the same number of people in 2023 that they did in 2003—20 years in which the U.S. population grew by more than 40 million. In part, states’ reliance on workforce savings in past recessions has made it harder to rely on this tool in future downturns—states were slow to restore head counts after both the Great Recession and the pandemic recession, if they restored them at all.

Furthermore, policymakers might have good reasons to want to avoid using workforce cuts to close budget gaps. In recent years, with the labor market tight and private employers boosting salaries to attract workers, states have struggled to fill open jobs. Agencies in states such as New Mexico, North Carolina, Montana, and Wisconsin have faced vacancy rates of 20%, 30%, or even 40%. With so many open positions, states have had difficulties performing core government functions. For example, Florida, New Hampshire, and West Virginia have called in the National Guard to help because they have been unable to maintain staffing at state prisons. While states have increased hiring and some report that they have begun reducing vacancy rates in recent months, actions to cut workforce costs—such as hiring freezes or furloughs—could jeopardize this progress.

Final Thoughts

State policymakers have long had limited flexibility to close state budget gaps; less ability to cut personnel costs could further reduce their flexibility. In light of this trend, states should reassess their approach to shortfalls to make sure they have a plan to bring the budget back into balance that will minimize harm to policymaker priorities and states’ long-term fiscal sustainably.

Rainy day funds are a big part of the solution. Notably, after their savings were largely depleted because of the Great Recession, state rainy fund balances have reached new records for nine consecutive years (measured as the number of days the median state could run on rainy day funds alone). If states depend less on workforce cuts and more heavily on rainy day funds in the next recession, that would fundamentally be a good trade. Workforce cuts risk diminishing public services; rainy day fund withdrawals do not. But that trade-off will only be possible if states continue to maintain sufficient reserves—and are ready to use them at the right time.

Josh Goodman works on The Pew Charitable Trusts’ state fiscal policy project.

Detailed Sources and Methodology: Depending on the year, Pew gathered data for Figure 1 from either the Census Bureau’s Annual Survey of State and Local Government Finances or the Census Bureau’s Annual Survey of State Government Finances. Data from the two sources are identical, but in some years only one of the two included the necessary state-by-state data. Salary and wage figures, however, were unusually low for certain states in certain years: New Jersey in 2002 and 2003, New Hampshire in 2004, and Pennsylvania in 2004. The Census Bureau confirmed that figures for these states and years reflected reporting errors and provided Pew with corrected estimates based on a different dataset, the bureau’s Annual Survey of Public Employment & Payroll.

Pew researchers then divided expenditures on salaries and wages by direct expenditures. They used direct expenditures instead of total expenditures to remove money that states provide to local governments. As a result, this measure is a truer gauge of the percentage of dollars that states themselves spend on salaries and wages.