White House Wants States and Localities to 'Engage in More Self Help' With Infrastructure

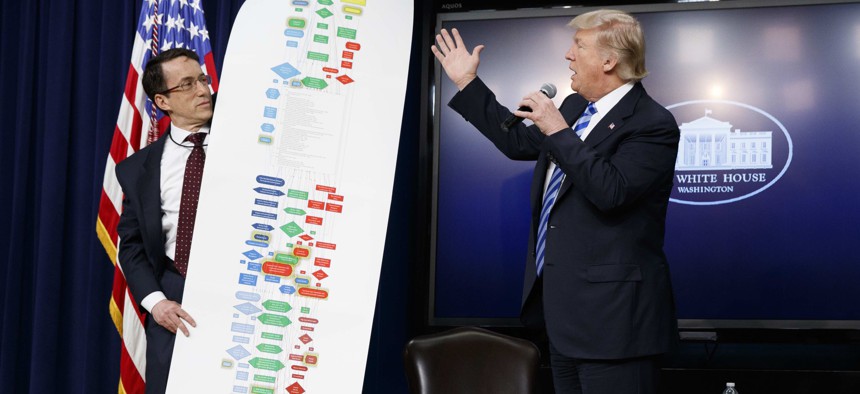

President Donald Trump, flanked by DJ Gribbin, Special Assistant to the President for Infrastructure Policy, left, looks at a chart of the regulatory process to build a highway, during April of 2017. AP Photo/Evan Vucci

An adviser to the president last week offered an update on the Trump administration's forthcoming infrastructure plan.

WASHINGTON — One of President Trump's top infrastructure advisers last week emphasized that the administration's pending investment plan for the nation's public works will be designed to push state and local governments toward coming up with their own money for projects before turning to the federal government for funds.

"We're trying to encourage state and local governments to engage in more self help. And to bring more money to the table," DJ Gribbin, special assistant to the president for infrastructure policy, said last Thursday at an industry event. Other administration officials have made similar comments previously.

Gribbin also noted that the administration wants to keep, for the most part, existing infrastructure funding programs in place, such as the Highway Trust Fund and so-called "state revolving funds."

And he said the White House does not have a list of projects that it wants to prioritize. "We are going to be agnostic when it comes to what infrastructure projects state and local governments want to fund and how they want to fund them," he added.

Gribbin made his remarks at the P3 Federal Conference in Washington, D.C.

He explained that, as it stands, the administration hopes to create an incentive program that would involve "a competition where people will send in lots of applications and those applications will be scored." Scores would potentially be multiplied, and boosted favorably, by the percentage of non-federal dollars applicants have available.

But Gribbin also stressed that everything he was describing is subject to change and was not official administration policy.

Turning to the tax overhaul effort happening in Congress, he said, that he'd personally like to see an existing tax exemption for private activity bonds preserved in any final bill, but that "it's highly unlikely, highly, highly unlikely that we would allow private activity bonds to influence our decision on whether we get tax reform or not."

"That's probably not a hill we're going to die on," he added.

A House-approved tax bill would eliminate the exemption for private activity bonds. The bill the Senate passed Saturday would not.

The Trump administration has indicated that it is supportive of an infrastructure package that would include $200 billion of direct federal investment, which could be combined with state, local and private funding to reach a total of $1 trillion.

Gribbin, during his comments, also outlined special consideration the White House is giving to rural infrastructure.

"If you think about the incentive program, in terms of us awarding federal funds to state and local governments that are generating a lot of revenue, that will be primarily in urban areas," he said. "A major component of our bill will be rural infrastructure. And there we're just block-granting formula funds to states."

It would possibly be up to governors, he said, to come up with plans for how these block grant funds would be used. Broadband, water systems and roads were options Gribbin mentioned. "The general theme of what we're trying to do is ask people to contribute a little bit more," he said, "but let them pick the infrastructure."

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: FedRAMP playbook walks agencies through the ATO process