Nuclear power could solve US electricity needs. But at what cost?

The most recent expansion of U.S. nuclear generation, at Georgia Power’s Plant Vogtle, cost $35 billion and took 15 years to build. Kristi E. Swartz/Floodlight

State lawmakers are increasingly eyeing nuclear power to boost clean energy. But as Three Mile Island and a Michigan reactor aim to restart, critics question whether the cost makes sense.

A shuttered Michigan nuclear plant is poised to start up again, buoyed by $3.1 billion in public subsidies.

In Pennsylvania, tech giant Microsoft said its need for more electricity led it to strike an unprecedented deal to buy all of the power for the next 20 years from one of the reactors at Three Mile Island—the site of the worst nuclear disaster in the United States.

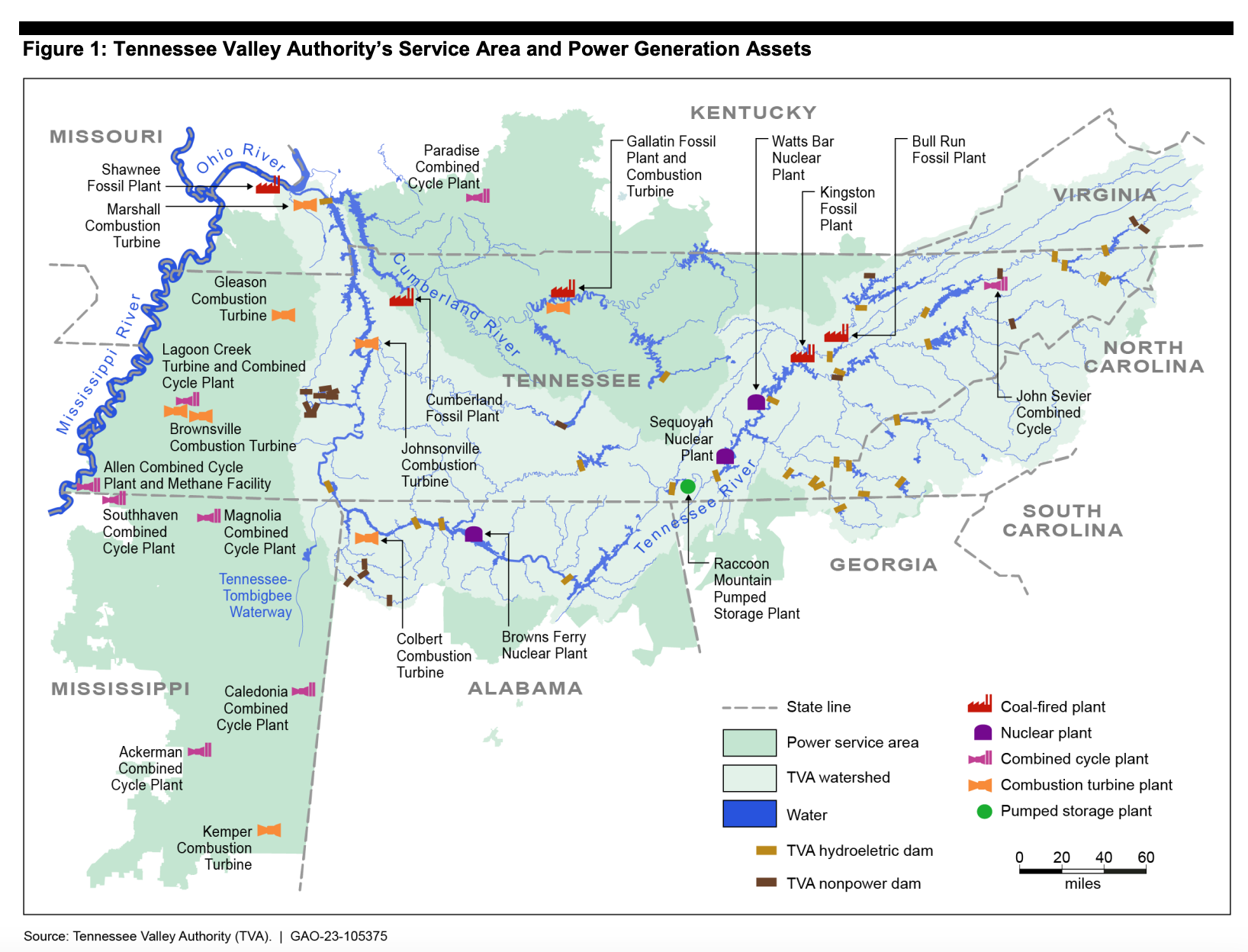

And the nation’s largest public power utility, Tennessee Valley Authority, continues to march towards building a small modular reactor (SMR), making it the first utility to do so in the United States.

“There’s never been more activity and excitement for advanced nuclear in the United States,” said Costa Samaras, a former senior White House policy leader in the Biden Administration and Carnegie Mellon University’s director of the Scott Institute for Energy Innovation.

Indeed, the federal government is pouring billions into keeping the nation’s current nuclear fleet operating and getting next-generation technologies ready for commercial use. The Bipartisan Infrastructure Law included $6 billion to prevent older reactors from shutting down prematurely, and the Biden Administration’s signature climate law, the Inflation Reduction Act, includes tax breaks, loan guarantees and other incentives for new reactors.

And in July, the president signed the Advanced Nuclear for Clean Energy or Advance Act, designed to streamline the siting and approval process for next-generation reactors.

Lawmakers in at least four states—Connecticut, Illinois, West Virginia and Wisconsin—have in recent years at least partially removed moratoriums on future reactors. Other states have included various tax breaks and other financial incentives for nuclear power in wide-ranging laws to boost clean energy.

The U.S. Department of Energy has identified 85 sites in 28 states where nuclear reactors would be suitable to replace closing coal plants. Montana and Wyoming are among those considering placing reactors on the sites of shuttered coal plants.

The agency added urgency to the need in a newly released report. It said the U.S. could triple the amount of nuclear energy by 2050 by building more large and small reactors and boosting the generating capacity of existing reactors, a process known as “uprating.”

The highly ambitious goal has a stark caveat: The country would need 275,000 skilled workers, tens of millions more tons of uranium, a large supply of critical components, “significant resources” added to the Nuclear Regulatory Commission and additional sites for nuclear waste storage and disposal. That work, the report said, needs to start now.

A New Landscape for Nuclear

From Bill Gates to the Energy Department, momentum is building behind nuclear again after a failed resurgence 20 years ago. Dozens of questions over cost, reactor design and the regulatory approval process remain, but a key difference stands out this time: the nation’s extreme need for more electricity.

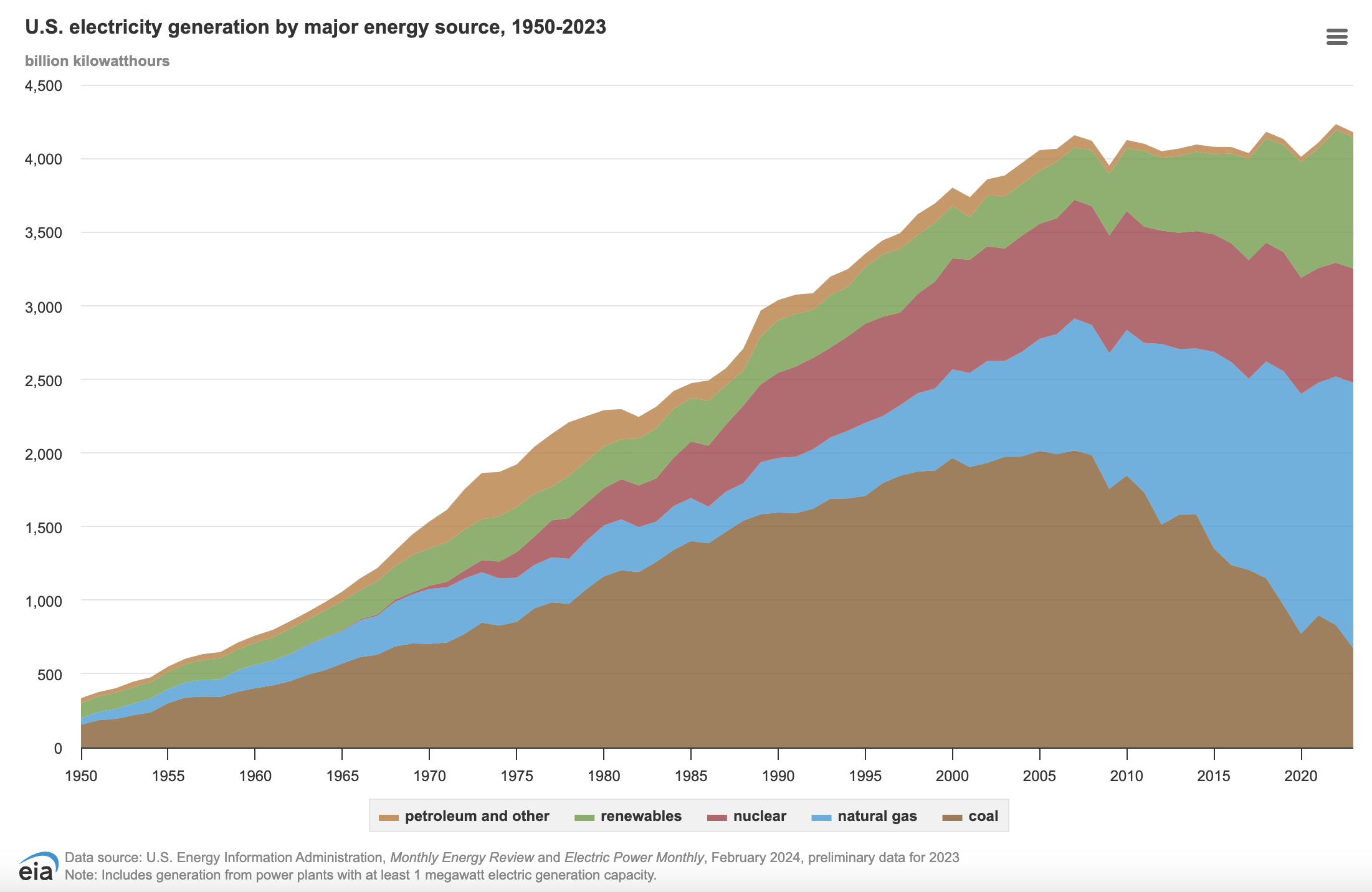

The United States and its electric companies have been running off of a stagnant demand for more power for roughly two decades. A combination of a recession, as well as LED light bulbs and more efficient appliances, shrank the need for more power generation sources. Just as the pendulum was about to swing the other way, the COVID-19 pandemic ground nearly everything to a halt.

But now, a plethora of planned data centers needed to support AI have sent many of the nation’s largest electric companies back to the drawing boards after projections for electricity demand as recent as last year are sorely inaccurate. The Biden administration, among others, also is pushing the nation’s heavy industry to be powered by electricity instead of natural gas to nudge the United States toward a carbon-neutral economy.

“(The) significant load growth that I think exceeded any one’s projections across the United States,” said Scott Hunnewell, vice president of TVA’s new nuclear program.

Most utilities are turning to building natural gas power plants, arguing they are the quickest and cheapest way to meet the burgeoning power demand. During this “very critical period,” Samaras warned, utilities shouldn’t default to the old way of doing business but instead insist on clean energy, such as geothermal and new, less expensive nuclear technology.

“I think it's the role of the public utility commissions and the public to say, ‘Are you sure that's the only thing you can do?’ ” Samaras said. “The public has an interest in ensuring that new load from all of these new sources doesn’t raise their bills and doesn’t hurt their lungs.”

Is Building New Nuclear Plants Possible?

The chief question is: Can it be done in time and at a cost consumers can afford? History says, “no.”

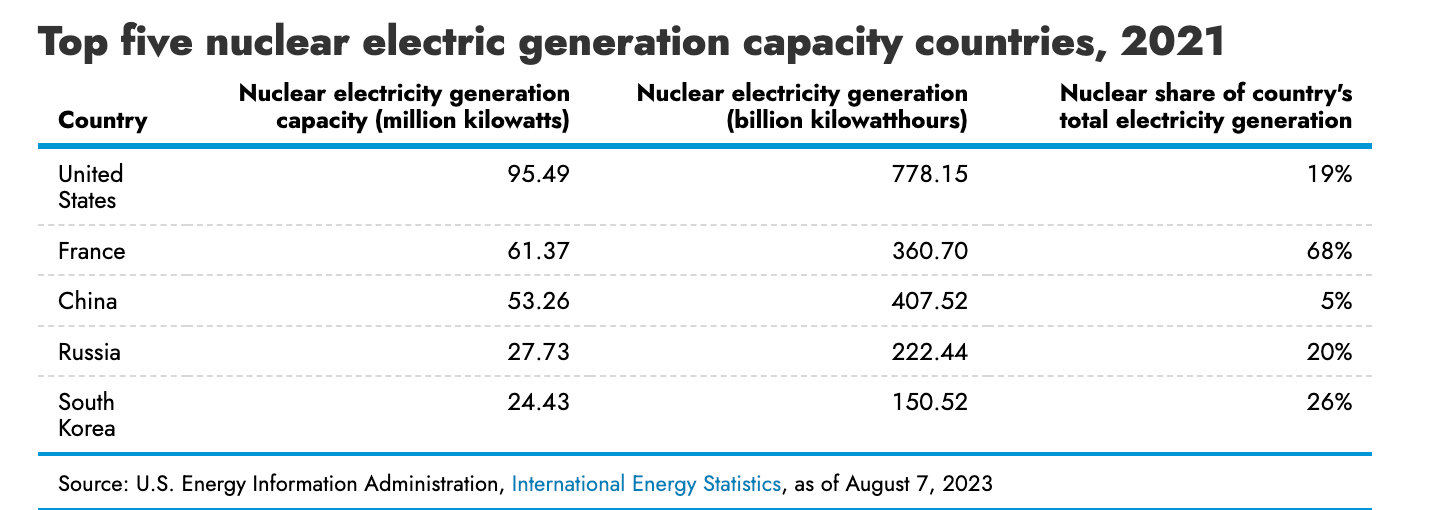

Currently, less than 20% of U.S. electric demand is met by nuclear power, yet it makes up slightly more than half of the nation’s clean electricity. The stringent safety requirements built into the permitting and construction process are part of what makes the reactors the most expensive type of power plant to build.

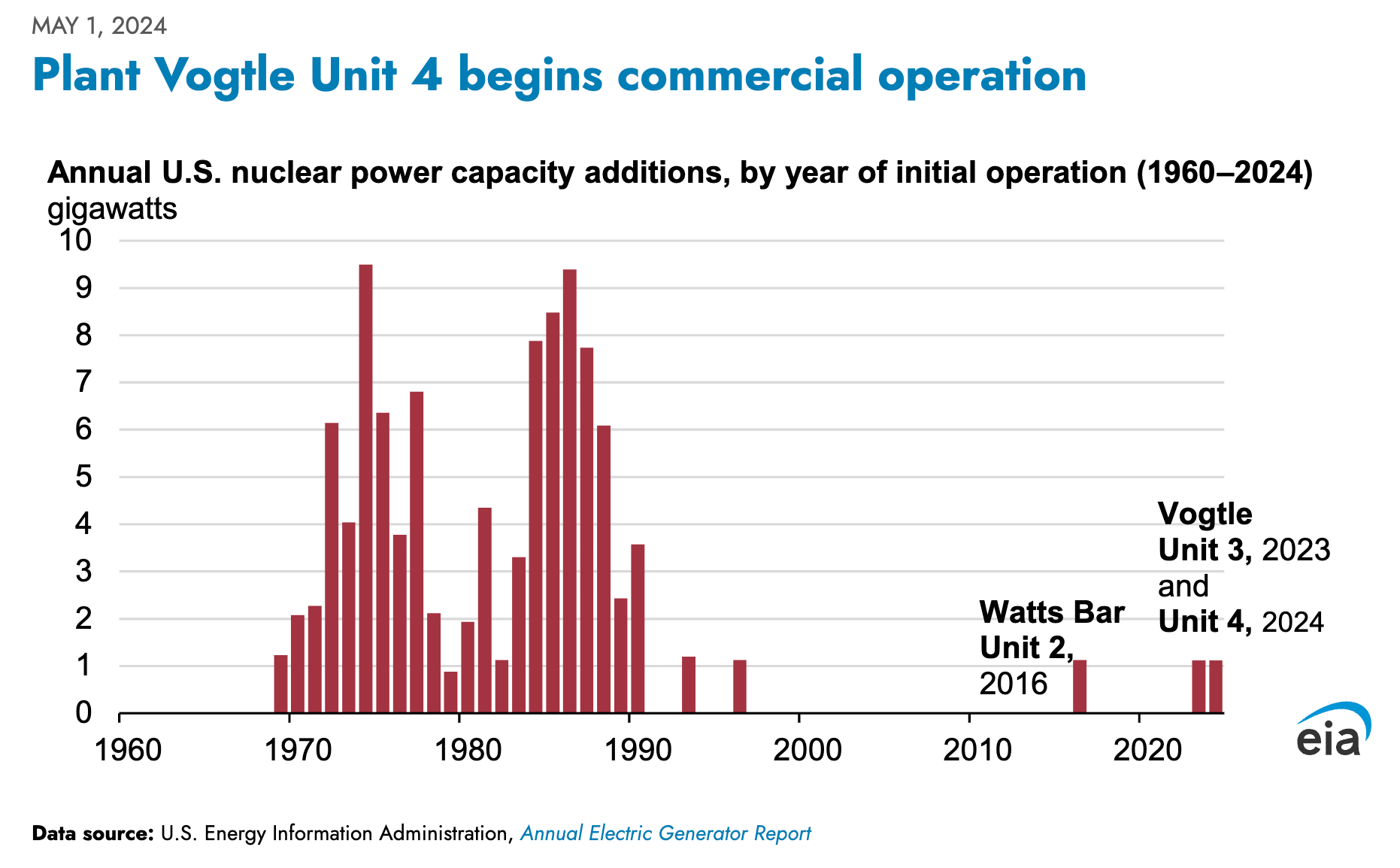

The most recent expansion of nuclear generation, at Georgia Power’s Plant Vogtle, southeast of Augusta, cost more than twice its original budget at nearly $35 billion and took 15 years to build. What’s more, the project’s original contractors, Westinghouse Electric Co., went bankrupt when the costs on Vogtle and a similar project in South Carolina skyrocketed.

“My instinct is it’s too heavy of a lift,” said Ed Lyman, nuclear power safety director at the Union of Concerned Scientists. “The fundamentals are still not there to support a massive expansion of nuclear energy in a short amount of time frame. It’s just not there … Too many difficult questions are just waved away.”

TVA, led by CEO Jeff Lyash, has been bullish on building small modular reactors and wants to submit a permit application to federal nuclear regulators during the first half of next year, Hunnewell said. The public utility, which serves 10 million customers across seven southeastern states, also is looking at sites where coal plants once stood.

TVA’s board recently approved another $150 million towards its proposed SMR, currently named Clinch River I. Hunnewell said SMRs cost “a fraction” of the billions of dollars it takes to build the larger reactors, but there are a range of price tags depending upon the size of the reactor.

The rising costs of what was supposed to be the first commercial SMR in the United States led startup NuScale and Utah Municipal Power Systems to squash its project roughly a year ago. Estimated costs went from $5.3 billion to $9.3 billion after construction costs jumped 75% from their original price tag.

“I think this is the most pro-nuclear administration in history, and I think that commitment is based on theology, if you will, rather than sound analysis,” said Armory Lovins, an adjunct professor who teaches on climate solutions and energy efficiency at Stanford University. “I don’t quite know what will change that other than market reality intruding after large amounts of money and time have been wasted,” said Lovins, one of four nuclear skeptics on an Oct. 3 panel who said the industry revival is “much hyped” and “already doomed.”

Small Modular Reactors Eyed

Meanwhile the Bill Gates-led TerraPower has broken ground on the site that is hoped to host a small, so-called Natrium reactor demonstration project in Wyoming. Gates has said the reactor will cost $4 billion, with half of that coming from the DOE.

TVA stands out because it currently is the only large electric provider in the United States that is pressing forward on building the smaller reactors, which have never been used commercially in the U.S. power sector. None of the others has committed to building SMRs or any of the other advanced reactor technologies, sometimes referred to as “Generation IV” designs.

Hunnewell likens it to a group of people standing on a cliff above a lake: “Whoever jumps first, everyone else will be comfortable in going. We’re willing to be that person that jumps first.”

TVA knows a lot of people are watching, “We’ve got to be able to complete the project on time and on budget. That’s what everybody is looking for: can it be done in nuclear.”

Achieving that would make history in the United States, as cost overruns have dogged the industry for decades. According to 2008 Energy Department report, the actual costs of 75 of the nuclear power plants exceeded their initial estimates by 200%. That leaves plenty of room for skeptics to say that restarting dormant reactors will suffer the same fate. Hennewell said TVA, a federal agency, will apply for a $900 million competitive grant from an IRA program run by the Energy Department.

But “even if we were going to get all of that money, that’s not enough” to finish the Clinch River project, and more “assistance” will be needed in the future, Hunnewell said.

And there’s another caveat: the SMR designs aren’t finished. Hunnewell said that’s likely two years away.

“And when the designs aren’t done, that increases your risk,” he said.

An Industry Meltdown

Just three nuclear reactors have started producing electricity since the 1990s.

A combination of regulatory red tape, safety-driven delays and mounting costs after a partial meltdown in 1979 at one of the reactors at Pennsylvania’s Three Mile Island ground the industry to a halt in the 1980s.

There were no deaths, injuries or health effects from the incident, but the public lost its trust in nuclear technology and safety. The accident led to broad changes across the industry, led by the U.S. Nuclear Regulatory Commission implementing tighter regulations in how reactors are designed and built as well as increased training in safety, emergency preparedness and operations—all of which sharply drove up the cost to build and run these power plants.

The Energy Policy Act of 2005 paved the way for the nation’s utilities to start building more large reactors again, kicking off a high-profile, highly anticipated industry restart. The nuclear industry and electric companies promised significant changes to the processes to approve, finance and build the multi-billion dollar reactors, and electric utilities, mostly in the Southeast, planned roughly three dozen reactors over the next three decades.

The restart was more of a false start because Vogtle Units 3 and 4 remain the only reactors built from the ground up in the last three decades. A third reactor, TVA’s Watts Bar II, opened in 2016 after the utility resumed construction in 2007. It had been sitting unfinished since 1985.

Meanwhile, the number of reactors currently operating has fallen to 94, with seven shut down for economic reasons. Operators deemed them too expensive to maintain and run compared to natural gas and renewables, particularly wind power.

Yet, Energy Secretary Jennifer Granholm stood at Plant Vogtle in mid-August and declared that the United States should build 98 more reactors just like the ones that are helping to power the state of Georgia. Samaras is among those who agree, at least in principle, arguing that the industry now has the workforce, supply chain and know-how to do this again.

“And so the question is, you know, for the industry right now is: will cost fall as more of these get built?” he said.

Restarting Nuclear Plants Not Easy—or Cheap

That’s not the only challenge.

A recent inspection of the shuttered Palisades Nuclear Power plant in southwest Michigan revealed potentially hundreds of millions of dollars in repairs may be needed before its owner, Holtec International Inc., can restart the plant, which has been closed for two and a half years. Its cooling towers must be rebuilt, and many of the steam generators must be repaired.

Constellation Energy, owner of the Three Mile Island nuclear plant, is pursuing a $1.6 billion taxpayer-backed loan guarantee from the Energy Department to help finance restarting one of the two reactors, the Washington Post reported.

Samaras has hope for the future of nuclear, pointing to the flurry of announcements—and money—coming from the government and private sector over the past three years. Engineers also are designing smaller, sleeker reactors that are safer, less expensive and easier to build, officials say.

In the meantime, some utilities have asked federal nuclear regulators for approval to keep running their reactors another 20 years—leaving them on the power grid for a total of 80.

But Lyman expects officials to find delayed maintenance that made those closed reactors uneconomic to run in the first place, and that is on top of whatever other costly repairs that need to be done.

“They aren’t going to be miraculously any cheaper than when they were shut down for financial reasons,” he said.

Floodlight is a nonprofit newsroom that investigates the powerful interests stalling climate action.