Should Cities Have a Different Minimum Wage Than Their State?

Workers rally in New York in September. a katz / Shutterstock.com

Debates over wage-requirements are common at the federal and state level, but now more municipalities are joining the conversation in an attempt to address variations in the cost of living.

The start of 2015 meant rising salaries for minimum-wage workers in 20 states and the District of Columbia. Workers in New York got their raise a day early, when the state increased the minimum wage by 75 cents on the final day of 2014. That’s over 3 million workers in the U.S. who will benefit from a pay raise this year, according to the Economic Policy Institute. But how significant are these wage increases when compared with the diverse cost of living across the country?

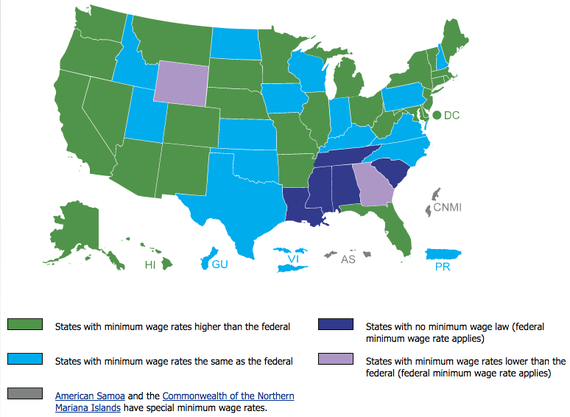

The federal minimum wage has sat at $7.25 since 2009, when it was raised from $5.15. Since then, many states have taken the task of hiking minimum-wage requirements into their own hands. These wages can vary greatly from state to state—from $5.15 in Georgia and Wyoming , to $9.47 in Washington. Some have matched federal requirements while others have boosted the minimum wage in their state even higher. And a few states refuse to set a minimum at all (employers are required to pay the highest minimum-wage rate applicable for their location, be it federal, state, or municipal). But what’s even more important than the dollar amount of this wage is the amount of buying power the salaries of these workers affords.

States' Minimum Wage vs Federal Minimum Wage 2015

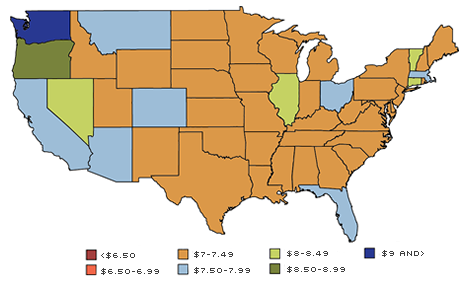

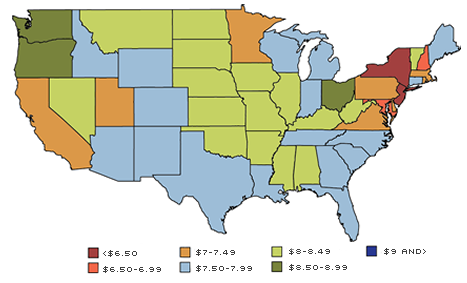

According to a 2014 study from the St. Louis Fed, despite the fact that many states had minimums that were close to the federal rate, when the cost of living in each state was factored in, minimum wages across the country became a bit more polarized . The report shows that when wages were adjusted for the cost of living, so-called real wages showed an increase in some areas, such as Texas, Idaho and the Dakotas. But these calculations of real wages decreased income in other areas including New York, New Jersey, and Rhode Island.

Actual 2012 Minimum Wage, by State

2012 Minimum Wage Adjusted for Cost of Living, by State

The recent pay bumps help some states that performed dismally on the real-wage comparison, like New Jersey and New York, move closer to federal parity after the cost of living is factored in, says Charles Gascon, an economist at the St. Louis Federal Reserve. According to the Economic Policy Institute, the most recent hikes will add about $1.6 billion to the pockets of workers. And the increases, even routine ones indexed to inflation, will help bolster buying power for workers, including those in states where real wages were already above the federally mandated $7.25.

But the level at which a minimum wage is set versus how that wage actually stacks up against living costs is a serious factor that varies not only between states, but between municipalities within states. A broad, state-wide minimum wage might get you a lot more of the basic necessities in some areas, but often leaves those living in pricier, urban locales—which often offer the best job opportunities —struggling to make ends meet. The Fed study found that in Illinois, the state minimum wage of $8.25 played very differently throughout the state. For those living in Chicago, a minimum wage set at $8.25 equated to $7.74 of spending power when accounting for the higher cost of living in the city. In Danville, about two-and-a-half hours outside of Chicago, the minimum wage equated to $10.39.

For some states, a more locally-based minimum wage might be an option for coping with the vast differences in purchasing power that can occur in one state, Gascon says. Cities SeaTac, Washington; San Jose, California; and Santa Fe, New Mexico all have their own minimums. And at the end of 2014, the city of Chicago voted to implement their own minimum wage which will rise to $13 by 2019, and be pegged to inflation thereafter. That made them the largest city in the U.S. thus far to implement a separate minimum wage, and the twentieth city overall to enact such a plan.

The idea of municipalities determining their own minimum wages isn't new, Santa Fe and San Francisco enacted theirs in 2003. But the trend has certainly picked up steam, with five local minimum-wage ordinances passed in 2013. That number more than doubled in 2014.

But for now, wage variations within states aren’t ubiquitous. Critics cite increased costs for businesses that might drive them out of cities and towns that require higher wages, or lead them to hire fewer workers. In 2014, Oklahoma passed a law explicitly prohibiting localities from raising their minimum wages on their own after Oklahoma City proposed an increase that would surpass the state and federal minimums. According to the National Employment Law Project, some of the economic fears that surround minimum wage increases—like the possibility of reduced job growth— have yet to appear in cities that have enacted local pay raises.

Active proposals in cities like Los Angeles and New York, which would raise minimum wages to $13.13 and $13.25, respectively, still await approval from city officials in L.A. and New York's state legislature. But the road to advocating for cities with different minimums than the states in which they are located sometimes requires lots of political maneuvering. In New York City, for instance, political leaders will have to grapple with a law that prohibits localities from enacting a separate minimum wage. Until then, many low-income workers in New York City will have to survive on the same salaries as their counterparts in much less-expensive areas of the state, like Utica or Buffalo.

( Top image via a katz / Shutterstock.com )