State Government Revenue Outlook Looking Sluggish

The Capitol Complex in Harrisburg, Pa. Jon Bilous / Shutterstock.com

Connecting state and local government leaders

A new brief from the State University of New York highlights demographic factors and slowing economic growth as reasons why sales and income taxes are expected to grow slowly in coming years.

Growth in state sales and income tax revenue is expected to be generally tepid in the coming two years, according to a new research brief that public policy analysts at the State University of New York released last week.

“The overall picture is of continued but sluggish growth in fiscal years 2016 and 2017 and continued fiscal challenges and uncertainties for the states,” Lucy Dadayan and Donald J. Boyd, of The Nelson A. Rockefeller Institute of Government, wrote in the brief.

Dadayan and Boyd cite expected slower growth in the overall economy and long-term demographic shifts as two factors contributing to the weaker state revenue forecasts.

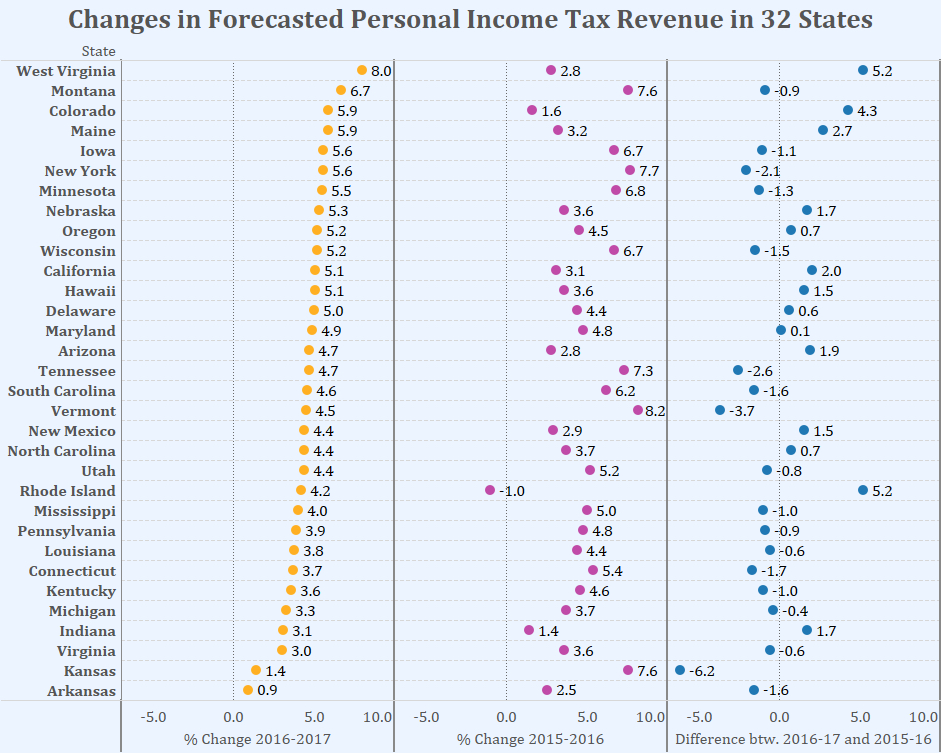

The median figure for forecasted state personal income tax growth among 33 states the researchers looked at is 4.6 percent for fiscal year 2017 and 4.4 percent for fiscal year 2016. Those figures are both lower than the median forecast for 2015, which was 6.7 percent.

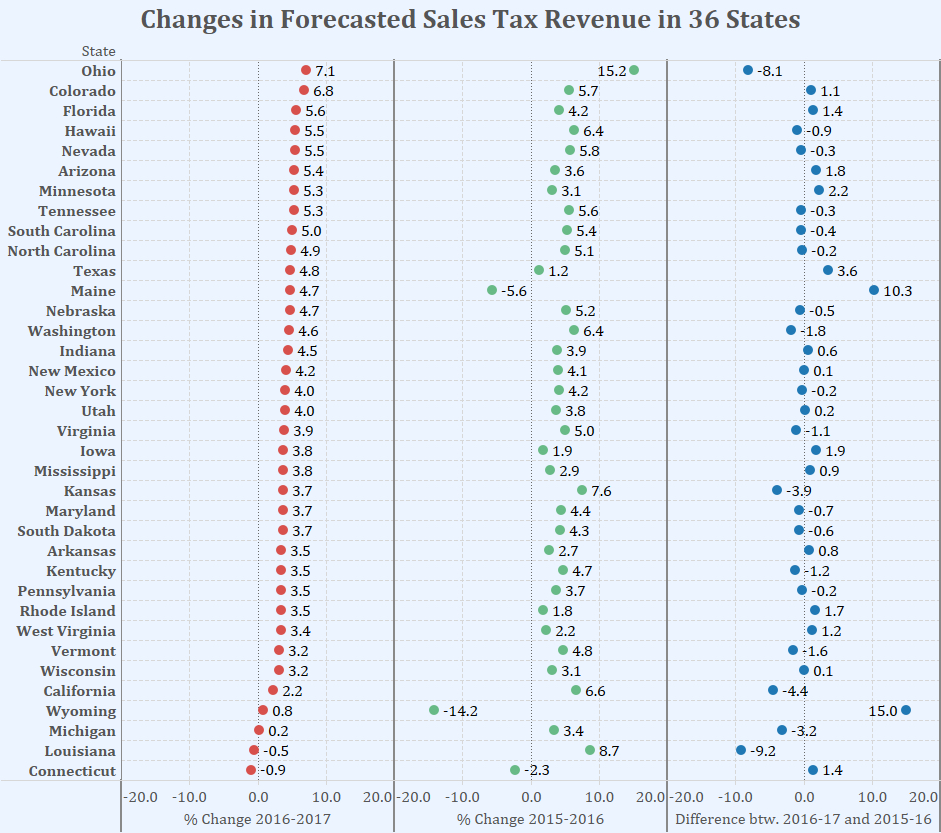

Sales tax forecasts exhibited similar trends. The median sales tax growth rate for 36 states, according to the brief, is 3.9 percent for fiscal year 2017 and 4.2 percent for fiscal year 2016. Both numbers are below the fiscal year 2015 median of 4.7 percent.

Dadayan and Boyd note that a strong stock market in 2014 buoyed income tax collections in the 2015 fiscal year. The fact that the market has cooled since then, they said, is likely one reason for the lower projections in state income tax growth in the coming two years.

But they also point out that the forces driving changes in revenue forecasts vary from state to state, and include things such as oil prices, the real estate market and policy changes.

Both Oregon and Pennsylvania, the brief notes, have acknowledged that an aging Baby Boomer generation is on track to temper future tax growth. As Boomers get older, working less and spending less, a smaller and smaller share of their income will be available for taxation.

Bill Lucia is a Reporter with Government Executive’s Route Fifty.

NEXT STORY: Water Utilities Embrace Customer Engagement