As States Step Back From Sales Tax Holidays, Wisconsin Gov. Embraces One

Wisconsin Gov. Scott Walker Carolyn Kaster / AP Photo

Connecting state and local government leaders

Scott Walker says his plan “will provide tax relief to the hard-working families” in his state.

MADISON, Wis. — Wisconsin Gov. Scott Walker on Wednesday announced that his state would be implementing a back-to-school sales tax holiday as part of his 2017-19 biennial budget proposal, something that stands out because other states have been eliminating them or paring them back in recent years.

“The sales tax holiday we plan to include in our 2017-19 biennial budget will provide tax relief to the hard-working families of Wisconsin sending their children back to school in the fall,” Walker said in a statement.

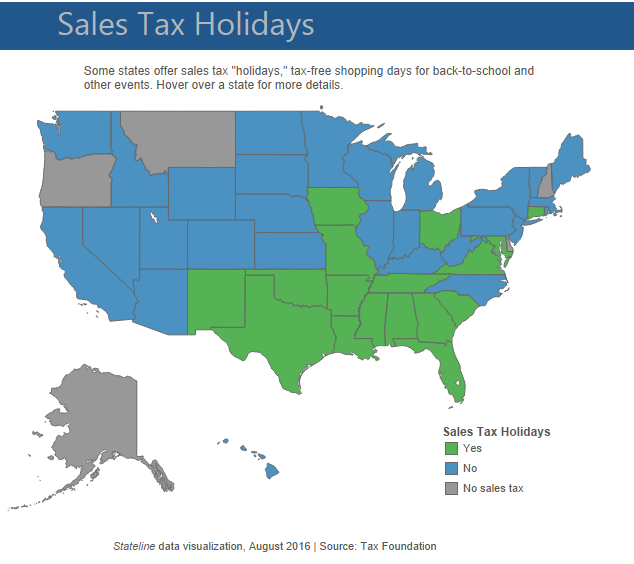

According to The Pew Charitable Trusts’ Stateline, the number of states offering a sales tax holiday, usually timed for the start of the school year, has been decreasing since 2010, when 19 states had some form of a holiday with no sales tax. Most of the 17 states that continue to offer them are in the South.

Massachusetts lawmakers this year decided not to give shoppers a late summer holiday from having to pay the state’s 6.25 percent sales tax on items with a price tag under $2,500—as it had in recent years. Legislators did so in the face of a budget deficit that has been projected to be as high as $1 billion. Florida legislators trimmed the state’s back-to-school tax holiday this year from 10 days to three and limited the tax break to purchases of clothing under $60 and school supplies under $15. Louisiana trimmed shoppers’ holiday savings by saying they had to pay 3 percent on their purchases this year instead of giving them the full 5 percent break.Efforts to revive North Carolina’s holiday, which was scrapped two years ago, failed this year ...

Wisconsin has a 5 percent sales tax and 62 of the state’s 72 counties collect an additional 0.5 percent sales tax, according to the Milwaukee Journal Sentinel.

Under Walker’s proposal, Wisconsin’s back-to-school sales tax holiday would be two days starting the first Saturday in August 2017 and would cover school supplies, computers under $750 and clothing items under $75 each. The proposal would sunset after two years, giving state lawmakers time to assess whether the sales tax holiday should be continued.

While retailers love sales tax holidays because they feel they help boost sales, critics counter that they’re bad fiscal policy. “I think the tax-free holiday makes great politics and lousy economics,” Florida state Sen. Tom Lee, who chairs his state’s Senate Appropriations Committee, told Stateline. “They are wildly popular, but they cannibalize on spending decisions that would have been made anyway.”

Michael Grass is Executive Editor of Government Executive’s Route Fifty and is based in Seattle.

NEXT STORY: Exploring New Strategies for Criminal Justice System Reform