State-Local Collaboration Needed Ahead of Opportunity Zone Deadline

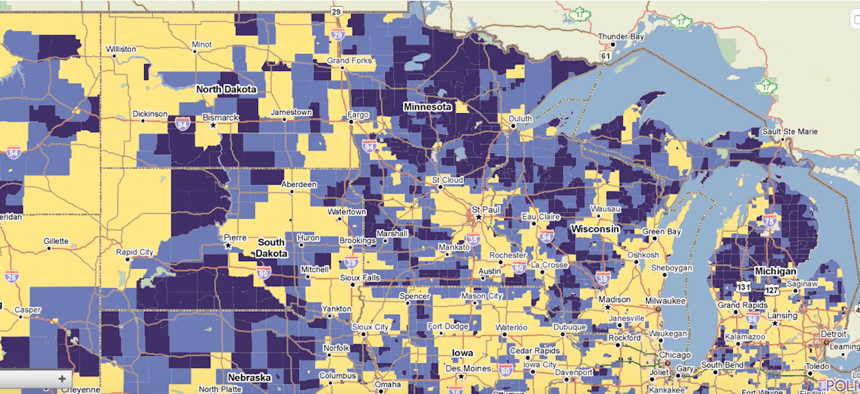

Areas in blue are eligible for the Opportunity Zones program. PolicyMap.com

Connecting state and local government leaders

While the impact of opportunity zones could be huge for low-income areas, the time is very short for states trying to figure out which areas to nominate.

CAMBRIDGE, Mass. — On March 21, governors around the country (as well as the mayor of Washington, D.C.) will nominate a subset of their low-income census tracts to be eligible for tax-advantaged private investment.

The program has the potential to unlock a huge amount of capital for rebuilding our nation’s distressed communities. An estimated 52 million Americans live in distressed ZIP codes that the national economic recovery of recent years seems to have passed by completely.

On a recent phone call hosted by Harvard Kennedy School and Living Cities, John Lettieri, co-founder and senior director for policy and strategy at the Economic Innovation Group and one of the architects of the Opportunity Zones program, explained the ins and outs of the initiative.

Included as part of the 2017 Tax Cuts and Jobs Act by U.S. Sen. Tim Scott of South Carolina, the program will allow investors to transfer unrealized capital gains into private-sector investment vehicles called Opportunity Funds. These funds will support projects undertaken in low-income, high-poverty census tracts.

According to Lettieri, the funds will invest in a range of assets from qualified corporations to partnership interests in property located in Opportunity Zones. Designed to incentivize long-term investment, the program rewards those who invest in Opportunity Funds for 10 years or more by making their additional capital gains tax exempt.

"[Opportunity Zones] are a particularly big deal at a time when a lot of other incentives are going away, and business as usual hasn’t been able to turn struggling communities around," said Lettieri. He added: "The [Opportunity Funds] help level the playing field, transforming passive investments in financial markets into productive investments in low-income areas."

The selected census tracts will tap into what some experts estimate is over $6 trillion in unrealized capital gains that could help rebuild neighborhoods still struggling after the 2008 recession. Regarding the investments that Opportunity Zones would induce, Lettieri was open-ended, noting: "A lot of activities are both needed and possible: operating business investments, real estate, energy, manufacturing, infrastructure and many more."

States may nominate only a limited number of census tracts for designation as Opportunity Zones. For that reason, Lettieri suggested that local officials work closely with their state counterparts to put their best foot forward.

"Governments should be thinking about balancing need and opportunity in selecting tracts and weighing the anticipated use cases in different communities," said Lettieri. He suggested that local officials such as mayors help bring together stakeholders from businesses and philanthropic communities to help governors articulate how they could best leverage an Opportunity Zone designation in their communities.

"The goal is to match State economic development priorities and other resources up with the Zone designations, so there's a multiplier effect,” said Lettieri. “Additionally, Opportunity Zones will favor communities that have recently suffered job losses from facility closures, business relocations, and local industry disruption. The program will lean heavily towards new creation: new businesses, new projects, and new development.”

EIG's website contains further information about Opportunity Zones and how to work with governor’s offices on zone designation.

Wyatt Cmar is a research assistant and writer for the Project on Municipal Innovation Advisory Group at the Ash Center for Democratic Governance at the Harvard Kennedy School of Government.

NEXT STORY: To Prevent Suicides and School Shootings, More States Embrace Anonymous Tip Lines