The Changing Face of First-Time Homebuyers

There are fewer people buying a first-home these days, but of those entering the real estate market, more are unmarried, Asian, or Hispanic. Shutterstock

Connecting state and local government leaders

There are fewer people buying a first-home these days, but of those entering the real estate market, more are unmarried, Asian, or Hispanic.

It used to be that most Americans aspired to marry and buy a home—in that order. But Millennials today are doing things differently: They’re delaying both marriage and childbirth (if they plan on doing either at all), they’re facing greater financial barriers to homeownership and a tougher housing market than the generations before them, and that’s causing many to rent instead of buy or to live at home with their parents.

This means that first-time homebuyers in the U.S. look significantly different from 20 years ago. New homeowners aren’t much older than before—the median age in 2017 was 34, compared to 32 in 1997—but they are more diverse, which is in line with demographic shifts since the 1990s. They also reflect the changing attitude towards homeownership among Millennials: Today, a larger share of new homeowners buy before marriage and form new households at the time of purchase.

The shift is detailed in a new working paper from Harvard University’s Joint Center for Housing Studies, in which researchers crunched demographic data from HUD and from American Housing Surveys taken every other year between 1997 and 2017. The latest survey reports nearly 1.8 million first-time homebuyers in 2016, representing 1.5 percent of all U.S. households and 38.5 percent of home purchases that year. That’s a drop in volume from 1997, which saw 2.13 million first-time homebuyers, representing 2.1 percent of all households and 45 percent of home purchases that year.

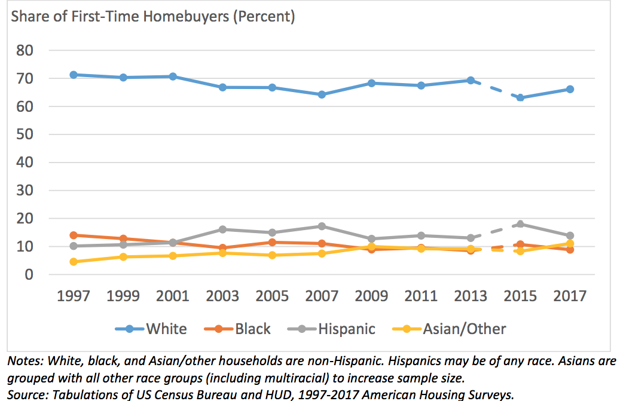

First-time home-buying rates for Asians surpassed whites; blacks still trail

At 66 percent, whites still make up the largest share of first-time homebuyers in 2017, though that’s a 5 percent-drop from 1997. Meanwhile, the share of households identifying as Asian and other has increased over that same period, from 5 percent to 11 percent—the largest gain among all races. That in part mirrors the boom in Asian Americans; at 72 percent, they were the fastest growing group between 2000 and 2015, according to the Pew Research Center.

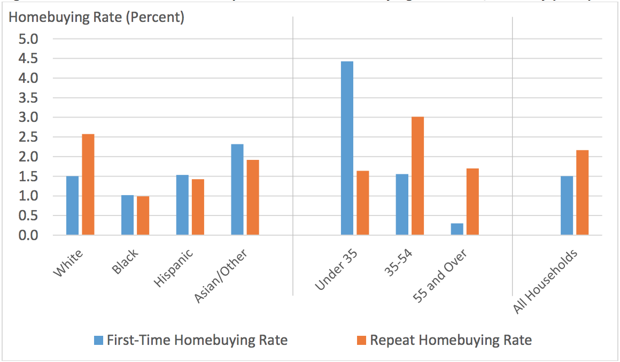

In fact, first-time home-buying rates in 2017 were highest among Asian/other households, surpassing the rate among white households. The study found that 2.3 percent of all Asian/other households were first-time homebuyers, compared to just 1.5 percent of white households.

Hispanics, the second-fastest growing group in the U.S., also saw gains. In 2017, they made up 14 percent of all first-time homebuyers. up from 10 percent in 1997. Among all Hispanic households, 1.5 percent are first-time homeowners.

Meanwhile, black households, which historically have been discriminated against in the housing market, continue to trail behind. They made up just 9 percent of first-time homebuyers in 2017, compared to 14 percent in 1997. The first-time home-buying rate among black households in 2017 is the lowest of all races, at just 1 percent.

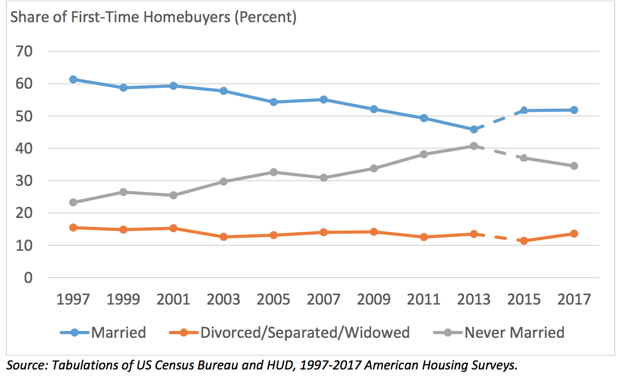

A Third of New Homeowners Today Are Unmarried

Perhaps the most notable departure from 20 years ago is the marital status of new homeowners. According to the paper, the share of married buyers declined from 61 percent in 1997 to just over half by 2017. In-between those years, the proportion dipped to as low as 46 percent in 2013. Meanwhile, 35 percent of first-time homebuyers in 2017 had never been married.

Though the researchers do not explore the causes behind the statistics, they write that the shift may be driven not so much by demographic shifts related to delays in marriage and childbirth, but by a trend in young Americans buying as individuals or with unmarried partners.

In fact, the National Association of Realtors puts together an annual profile of all homebuyers in the U.S. In its 2019 report, researchers found that 15 percent of all Millennial homebuyers under 29 years old bought as an “unmarried couple.” While that usually means with a partner, that’s not always the case. As housing prices and down payments increasingly become out of reach for individual buyers, it’s not uncommon for friends and siblings to pool their resources and take out a mortgage together.

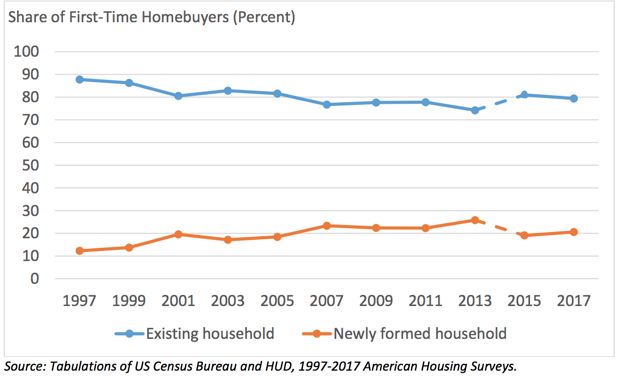

First-time Buyers Are Forming New Households

In 2017, more than a fifth of first-time homebuyers formed a new household at the time of purchase. More striking, the study found that between 1997 and 2013, the proportion forming a new household more than doubled, from 12 percent to 26 percent of all first-time homebuyers. Of that, 12 percent came from living with a homeowner, and another 8 percent previously lived with a renter.

The study doesn’t break down who those previous homeowners and renters were. "But what that means, potentially—and this is just an example—there may be more people living with folks and saving up as opposed to previously—maybe 20 years ago—where a couple might rent together and enter homeownership,” says Sean Veal, a research assistant at Harvard who co-authored the report.

Between crushing student debt, skyrocketing rents, and underemployment, more college graduates are crashing with mom and dad until they can find financial stability. A study using 2016 Census data, from the real estate site Zillow, found that overall, the share of young college graduates moving back home jumped from 19 percent in 2005 to 28 percent in 2016. Miami and New York had the highest shares—45 percent and 42 percent, respectively. For some Millennials, according to MarketWatch, that means they’re skipping starter homes and going for larger houses as their first purchase.

Meanwhile, the share of grads living with a romantic partner dropped from 44 percent to 34 percent in that same time span.

“We're not really saying what causes this kind of change,” says Veal, emphasizing that the report should be used as a guide on the characteristics of new homeowners, “but what we can infer is that there is a different type of change going on, like maybe increases in nontraditional households.”

Linda Poon is a staff writer at CityLab covering science and urban technology, including smart cities and climate change.

NEXT STORY: Starving Seniors: How America Fails To Feed Its Aging