In Fire-Prone California, Many Residents Can’t Afford Wildfire Insurance

A wildfire burns near homes in Corona, California. Tim Gray/Shutterstock

Connecting state and local government leaders

COMMENTARY | In the past four years, insurers have dropped more than 340,000 policyholders in fire-prone areas.

California’s relatively quiet 2019 fire season ended in October. Just days after Pacific Gas & Electric cut power to half a million customers in Northern California during high-wind conditions, the Saddle Ridge fire in Los Angeles County exploded in size overnight, burning some 8,000 acres.

There are many things Californians can do to prepare for these blazes, but one option – taking out wildfire insurance – is out of reach for many of them. For example, after massive fires in 2018, an estimated 350,000 Californians could no longer get property and casualty insurance that also covered fire.

Over the past several years, premiums have risen significantly – as much as 300% to 500% in many cases. And in many high-risk areas, insurers are increasingly opting not to renew coverage.

In the past four years, insurers have dropped more than 340,000 policyholders in fire-prone areas. Owners who can’t find private wildfire insurance must rely on California’s FAIR plan, a state-backed pool of insurers who provide basic coverage for a high price as a last resort.

My research focuses on renewable energy finance and policy in the U.S. and abroad. One major challenge in developing energy projects is putting a price on risk. That’s also what insurers do when they consider whether to offer coverage and how much to charge. My work on assessing risk and finance has drawn my attention to wildfire risk and the ways that insurance policies can be adjusted to address today’s challenges in California.

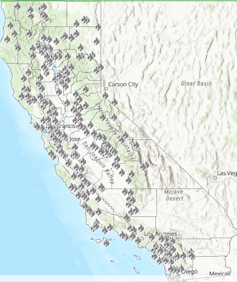

A Statewide Threat

California faces wildfire risks on an epic scale.

In 2017 wildfires caused at least US$18 billion in damages, including $13.2 billion in insured losses, $3 billion in other economic losses and $1.8 billion in fire suppression costs. In 2018 a total of 8,527 fires burned 1,893,913 acres, the largest area recorded in a fire season. The disastrous Camp Fire caused $16.5 billion in damages, including $12.5 billion in uninsured losses.

Multiple factors are creating the conditions for these blazes. Climate change has increased the severity and volatility of weather factors such as rainfall and temperature. Reduced logging and forest clearing have left more fuel on the ground in forests. And development is moving into higher-risk areas. These drivers have increased both wildfire risk and economic damages from wildfires.

Challenges for Insurers

What do these trends mean for the insurance industry?

First, risks are increasing not only in severity but also in uncertainty. Insurers report that the models they use to estimate wildfire risk are no longer effective.

There also is danger of a trend that economists call adverse selection. This occurs when costs are spread across low- and high-risk customer premiums, so that low-risk customers end up subsidizing high-risk customers.

As wildfire risks and insurance premiums increase, only owners of high-risk properties may choose to purchase fire insurance, while those with lower-risk properties opt out. As lower-risk owners leave, premiums will rise further for high-risk owners, driving more of them out of the pool and raising premiums still higher.

Spiraling premiums may create over-reliance on the FAIR plan, which was designed to provide basic coverage for residents who are unable to obtain it from private insurers, not to insure a property’s full value.

Better Forecasts and a Bigger Market

To manage these challenges, Western states and industry need to develop more accurate models that can help insurers assess and price wildfire risks appropriately. These models will need to be more accurate in both space and time than current versions.

For example, they may need to identify specific properties, as opposed to city blocks or even larger areas. They also will need to recognize that climate change is altering longstanding weather patterns, so that predictions based on the past observations may no longer produce accurate results.

Current models predict fire risk well in advance, but insurers may also need tools that can predict risks at the present time. Commercial modelers such as RMS and startups like Terrafuse, where I am an adviser, are developing such models.

Another priority is ensuring that there is robust and guaranteed demand for wildfire insurance, which will attract private insurers into the market. This can be done by requiring all homeowners statewide to obtain coverage. Such a rule would resolve the problem of adverse selection, much as the individual mandate in the Affordable Care Act was designed to ensure that healthy Americans participated in the health insurance market.

This step could require separating wildfire insurance from general property insurance, which typically covers fire, in the same way that insurers already sell earthquake and flood insurance separately, and then requiring all residents in California to buy wildfire insurance.

Higher Premiums in Riskier Zones

A universal insurance mandate would need to be combined with a requirement for risk-based pricing, so that premiums adequately reflect wildfire risk. This approach would require homeowners to pay more for insurance in areas where fire risk is highest, such as neighborhoods abutting forested areas.

Pricing coverage this way is important in order to avoid the well-publicized failings of the National Flood Insurance Program, which did not adopt full risk-based pricing until 2019. Offering federally backed flood insurance for decades without factoring in risk gave homeowners incentive to build properties in high-risk areas, with the knowledge that flood insurance would pay their rebuilding costs if they suffered storm damage.

Another key requirement, also inspired by the flood insurance program’s flaws, is to make FAIR the insurer of last resort. In other words, people could only buy coverage from it if no other options were affordable. This would help avoid crowding out private insurers.

One challenge is that lower-income housing developments already exist in high-risk areas, including zones where wildfires have increased in recent years. For these homeowners, premiums may still be unaffordable. In such cases, income-based insurance subsidies may be needed.

I believe these proposals would help California officials ensure that wildfire insurance is universally available, at the lowest possible cost, using public resources in a way that does not crowd out the private sector. Insurance is not a substitute for fire prevention policies or investments in wildfire response, but it is one necessary tool for managing the state’s serious wildfire risks.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Gireesh Shrimali is a precourt scholar at Stanford University.

NEXT STORY: One City Council Considers Mandating a $30 Minimum Wage for Rideshare Drivers