Regulators Scrutinize Buy Now, Pay Later Plans

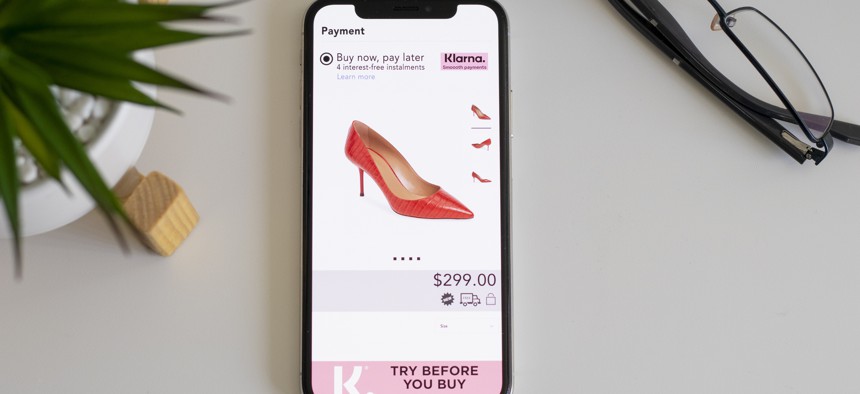

Klarna is an emerging buy now pay later service provider. iStock.com/Ross Tomei

Consumer advocates worry about buyers overextending themselves.

This story was originally posted by Stateline, an initiative of the Pew Charitable Trusts.

The buy now, pay later enticements increasingly offered on websites’ checkout pages lure many customers, especially as the coronavirus pandemic has increased online shopping.

But the exploding use of buy now, pay later plans also is drawing more scrutiny from state and federal authorities over concerns that the practice may not be sufficiently regulated.

The plans allow customers to pay a small portion of the price upfront, receive the item and then pay the remainder in installments. Unlike credit cards, there’s no initial interest charge. But many consumers may not fully understand the plans’ implications, such as unexpected fees and possible harm to credit scores for late payments.

“Consumers can accumulate a lot of debt without realizing it,” said Lauren Saunders, associate director of the National Consumer Law Center. “There’s no interest, but a lot of these plans have big late fees, and that can accumulate more than interest.”

California is leading the way on regulations, and late last year classified the buy now, pay later plans as loans, bringing companies that offer them under the state’s lending rules. Using that expanded regulation, California officials aggressively have gone after a couple of companies that the state said were not sufficiently disclosing terms or protecting consumers.

At least a handful of other states are examining whether expanded rules or new regulations might be needed. And the federal Consumer Financial Protection Bureau opened an inquiry last month into companies that offer buy now, pay later credit, seeking input from merchants who use the service, other kinds of creditors and consumers.

But regulators have had trouble categorizing the type of products the companies sell, and therefore have difficulty crafting regulations.

The plans have grown exponentially. A September report by Accenture, a financial consulting and information technology firm, showed that the number of buy now, pay later users in the United States grew by more than 300% per year since 2018, reaching 45 million in 2021.

More than 37% of Americans had used a buy now, pay later service as of July 2020, according to a survey by The Ascent, a product review service from investment advice company Motley Fool. That jumped to nearly 56% by March 2021. While the buying plans took off online, brick and mortar retailers are using them as well.

Most buy now, pay later plans require the consumer to split the cost of their purchase into four payments, usually made every two weeks. The buyer receives their item with the first payment. No interest is charged if the consumer pays on time. Merchants pay a small fee—usually between 2% and 8%—to the buy now, pay later companies that provide the short-term financing. By comparison, merchants generally pay 1.5% to 3.5% to credit card companies for the use of that service.

Some of the buy now, pay later financing companies charge a fee if a customer is late with a payment. Some, but not all, report the transactions to credit bureaus.

A survey conducted late last year by Credit Karma, a financial services company, found that more than a third of respondents who had used buy now, pay later plans reported falling behind on payments.

Amanda Pires, a spokesperson for Afterpay, one of the most used buy now, pay later companies with about 15 million customers, said in an emailed response to questions that the company is “not a loan or a credit product, which means that there is no revolving debt or interest charged to the consumer. We’re proud to say that 95% of transactions never incur a late fee.”

Late fees of up to $8 per payment can be assessed, she said, but the fees are capped at 25% of the individual order amount. If customers miss payments, they are banned from the platform until they pay, she added.

But regulators and experts dispute the argument that buy now, pay later plans are not loans. California’s Department of Business Oversight alleged in 2019 that Afterpay is in fact a lending company, and that it was offering illegal loans in the state. The state reached a settlement in which Afterpay had to refund $905,000 to California consumers and pay more than $90,000 in administrative fees. The company also had to get a lender’s license from the state.

Afterpay disputed the state’s allegations in a statement at the time, saying it didn’t operate illegally. Pires wrote in an email last week that the company still stands by the statement.

She and representatives of other buy now, pay later financing companies insist that consumers use the platform as a budgeting tool, because they can calculate the biweekly cost of the transaction and plan for the expense.

California decided to regulate the companies “in short, because these products are loans,” said Adam Wright, senior counsel for the California Department of Financial Protection and Innovation, formerly the Department of Business Oversight.

“They weren’t overseen by dedicated financial overseers like our office,” Wright said in a phone interview. “They are loans, and they should be regulated by someone like us, under a law that has more protections for consumers.”

In 2020, California regulators granted a loan license to the buy now, pay later company Sezzle, after first rejecting the company’s application. It approved the license after Sezzle, which had previously operated in the state by arguing it didn’t need a license, paid a $28,000 penalty and refunded $282,000 to Californians.

Penny Lee, CEO of the Financial Technical Association, which represents a number of buy now, pay later companies, including Afterpay, Klarna, Sezzle and Zip, said her members are working with regulators, both state and federal, to “ensure that standards are met, and compliant with all regulatory rules. They want to ensure there is transparency in the market.”

She said the companies have put in place safeguards to make sure consumers are not overextended, including “pausing” their accounts or cutting them off if they fail to make timely payments. “They want consumers to have a good experience with this product,” she said in a phone interview.

Affirm, one of the larger companies with its roughly 17 million transactions since launching in 2012, lately has been expanding its offerings beyond the standard model of four biweekly installments. The company also offers monthly payments and charges interest on purchases for some big-ticket items such as furniture, according to spokesperson Nicholas Fisher.

Late payments are reported to credit bureaus on some of their products, he wrote in an email. “This allows consumers an opportunity to build their credit history while also providing information that would hopefully encourage responsible risk managers from overextending the consumer.”

Despite the companies’ efforts, several states are weighing how to regulate these new products.

A spokesperson for the Oregon Division of Financial Regulation, Mark Peterson, wrote in an email that the department is continuing to “monitor these sorts of financing options for consumers and gauge consumer protection concerns. We are a part of several [state] regulatory organizations that are contemplating further action in this space, such as the creation of state statutes that provide regulatory oversight to these sorts of options.”

Lucinda Fazio, director of consumer services at the Washington State Department of Financial Institutions, said whether buy now, pay later firms constitute loan companies is difficult to assess.

Many of the products skirt a state law designed to oversee retail installment sales and contracts, such as car loans or furniture loans, that contain interest charges, Fazio said in a phone interview. “And each state implements that statute differently. In the state of Washington, in our agency, we do not [use] that statute” with buy now, pay later companies.

Massachusetts requires small loan companies and retail installment finance companies to have a state license. The state classifies Affirm as a small loan company, but had not classified the other large buy now, pay later companies in any way as of Oct. 1, the latest date for which a list is available. An official for the Massachusetts Office of Consumer Affairs and Business Regulation would not comment on why other buy now, pay later firms don’t fit the definition.

Like with the Afterpay case in California, Affirm entered into a consent agreement with Massachusetts regulators in July 2020 after allegations that it engaged in loan servicing activity without a license. The firm paid a penalty of $2.25 million and agreed to register for a license.

The Consumer Finance Protection Bureau’s inquiry includes a look at the states’ actions, said Laura Udis, program manager for small dollar and installment lending markets at the agency. “Those companies are now licensed as consumer finance lenders in California. I think many states are looking at this in terms of the application of different state laws.”

Elaine S. Povich is a staff writer at Stateline.

NEXT STORY: Texas National Guard Troops Call Abbott’s Rushed Border Operation a Disaster