Government Wage Growth Lags Private Sector by Largest Margin on Record

Prison guards talking at the Cybulski Community Reintegration Center in Enfield, Connecticut. Corrections agencies in many states have had trouble filling positions, which often pay less than private sector jobs. GETTYIMAGES/John Moore

How state and local leaders are responding to the widening gap will have long-term budget ramifications.

When Minnesota Department of Corrections recruiters were seeking to fill hundreds of vacant positions last year, they noticed some major salary discrepancies with private sector jobs. Despite a 2.5% pay increase for much of the department’s unionized workforce that summer, the starting hourly wage for corrections officers was still nearly $9 below what FedEx was offering.

Unable to compete with the higher pay, officials responded by offering substantial hiring incentives. Corrections agencies in other states have done the same. Such predicaments have proved common among state and local agencies as they face severe staffing shortages.

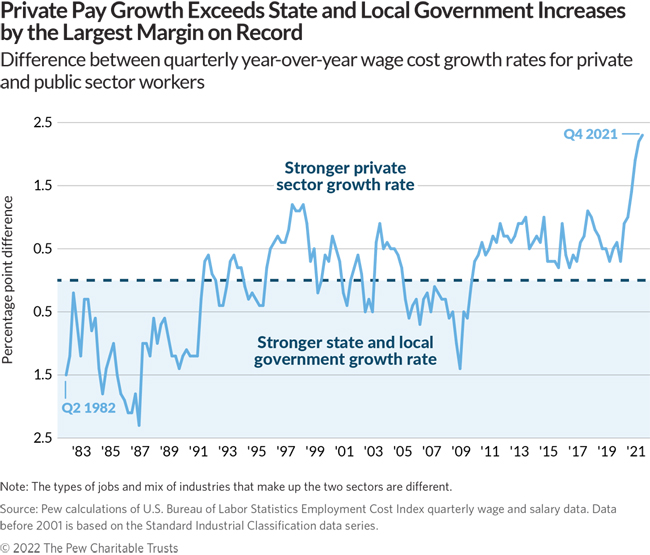

Nationally, pay increases for state and local government employees haven’t kept pace with those of private workers, who generally have enjoyed much stronger gains as the economy recovers. A Pew analysis of Labor Department data shows that the year-over-year growth rate for hourly private sector salary and wages in each of the past four quarters has exceeded that for state and local governments by the largest margin on record. To make matters worse, public employee wages aren’t keeping pace with high inflation. Concerns over pay have compounded an already difficult situation for governments in recruiting and retaining staff and put additional strains on public services.

Some states, cities, and school districts have started confronting these growing wage pressures, but the public sector generally has been much slower than private companies to implement changes. Government pay raise proposals are often subject to lengthy approval or union negotiation processes, or they require authorization from elected officials. Many jurisdictions either don’t have enough fiscal wiggle room or are hesitant to commit to the recurring costs of permanent pay raises. How they respond has important long-term implications for their budgets, potentially causing challenges if revenue fails to keep up with new spending commitments.

Private sector wage growth already slightly exceeded that of state and local government before the pandemic. Last year, however, differences in year-over-year growth rates more than doubled to the highest levels in nearly four decades in the wages and salaries component of the Labor Department’s Employment Cost Index, which measures changes in labor costs per hour worked. In 2021’s fourth quarter, private sector wages were up 5% over the year, compared with 2.7% for state and local governments, not accounting for inflation. This represents a reversal from the Great Recession, when public employee wages initially held up better.

The slower wage growth has contributed to a sluggish recovery of public employee jobs. Total state and local government employment was down 3.7% in January 2022 from February 2020, just before the pandemic took hold, compared with only a 1.7% decline for the private sector.

In many states, lawmakers view raising pay as critical to holding on to employees wooed by private companies. “The private sector, which is always quick to respond to opportunity, is picking off some of our best and most talented,” warned Wyoming Governor Mark Gordon (R) at a recent state legislative hearing.

Many states and local jurisdictions have approved pay raises thanks in large part to budget surpluses caused by higher-than-expected tax revenue and multiple rounds of federal aid. Some have targeted workers who performed essential services during the pandemic, while broader measures elsewhere covered more workers. More recently, governors in Kansas, Missouri, South Dakota, West Virginia, and Wyoming have proposed pay increases for state employees.

By and large, though, government wage increases over the course of the pandemic don’t nearly match the speed and scale of those in the private sector. One major reason: Most of the federal pandemic relief is temporary or one-time funding, so state and local officials have been cautious about pay increases that raise expenses for future budgets.

“There’s some hesitancy to make long-term commitments,” said Leslie Scott, director of the National Association of State Personnel Executives.

Salaries and wages are a major line item in budgets, accounting for about 21% of all states’ fiscal year 2020 current operating costs. The percentages range from 16% in Florida and Maine to 32% in Hawaii, according to U.S. Census Bureau data. If new ongoing spending commitments such as salary increases are not offset by recurring revenue, governments could face long-term budget imbalances. To inform these critical decisions, some states use multiyear budget projections and distinguish between one-time and ongoing revenue and spending.

Instead of permanent pay increases, some officials have approved temporary bonuses or hazard pay. In Florida, the Sarasota County School District countered a union-proposed 6% across-the-board increase in November with $2,500 bonuses for all teachers and $1 hourly raises for unsalaried staff. At the time, the district’s chief operating officer said the system had to be mindful of recurring costs because temporary federal funds had helped to enlarge its reserve fund balance. Similar debates played out in other school districts.

State and local agencies also have touted bonuses as a recruitment tool. In December, the Minnesota Department of Corrections began offering hiring bonuses of $5,000 after two years of service as it sought to fill about 200 officer vacancies. Lisa Kelly, a recruiter with the department, said wages were a “big factor” for younger employees, who tend to be less concerned with health or retirement benefits. Early indications suggest that the bonuses are generating substantial interest, with a fivefold increase in applications in December 2021 compared with previous months, she said.

Another possible reason for governments being slower to implement pay increases is the vast size of workforces that span numerous agencies. Officials may want to avoid unintended repercussions, such as employees switching departments. “As increasing the salary for any one job class has a domino effect across the enterprise (especially with those at the lower end of the pay scale), it’s necessary for us to adopt a more deliberate and measured approach,” said Jay Gasdaska, director of Pennsylvania’s Office of Employee Relations and Workforce Support.

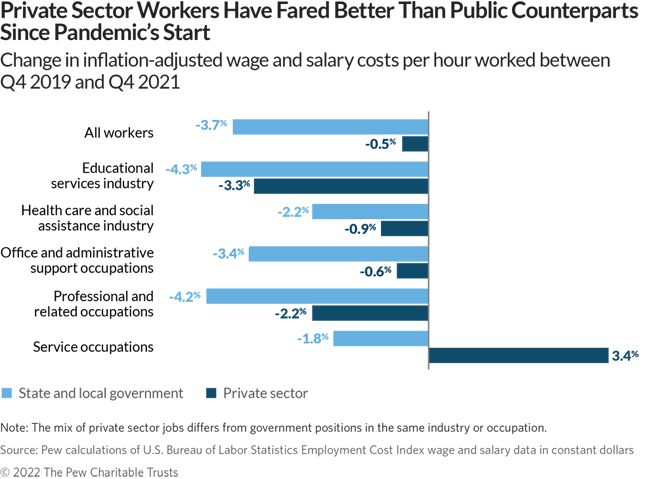

Private sector wage increases outpace those of similar jobs in government

Wage increases for private workers are generally exceeding those of public employees employed in similar industries or occupations. Federal data shows particularly large differences for service work. In addition, state and local government employees’ paychecks aren’t just lagging behind those of their private sector peers; they also are not keeping up with high inflation. Since the last quarter before the pandemic, they are down an inflation-adjusted 3.7%. Over the same period, private industry wages were down 0.5%.

The Arkansas Office of Personnel Management noted last year that competing offers from Walmart, McDonald’s, Amazon, and other businesses raising wages were impeding their efforts to fill lower-grade positions. Nationally, many public agencies have struggled to fill positions in corrections, health, social services, and road maintenance.

A MissionSquare Research Institute survey released Jan. 27 found that 52% of state and local workers were considering changing jobs, retiring, or leaving the workforce for other reasons. It identified improving salaries as the top action that governments could take to retain workers. But pay and competition from private companies are not the only factors holding back public sector employment. Some might not want to work because of health risks or family considerations. In other instances, suspension or scaling back of public services because of the pandemic is contributing to fewer jobs.

Going forward, states will need to take further steps to improve their work environments and offer more flexibility such as remote work options, said Scott, who runs the association of state personnel executives. How well governments compete with private employers for talent over the long term then will hinge on more than wages alone.

This analysis is based on the wages and salaries component of the Employment Cost Index published by the U.S. Bureau of Labor Statistics. The index measures changes in costs to employers per hour worked independent of the influence of shifts in employment among industries. Wage data includes hazard pay and incentive-based pay but excludes benefits, broad-based bonuses, and most other forms of compensation. Pew’s calculations represent growth rates and do not compare compensation levels or which groups of workers are paid more. State-level estimates were not available.

Mike Maciag is an officer with The Pew Charitable Trusts’ state fiscal health initiative.

NEXT STORY: Teachers ‘Beaten Down’ By Staff Shortages, Covid