Expanded health insurance for immigrants gains traction in states

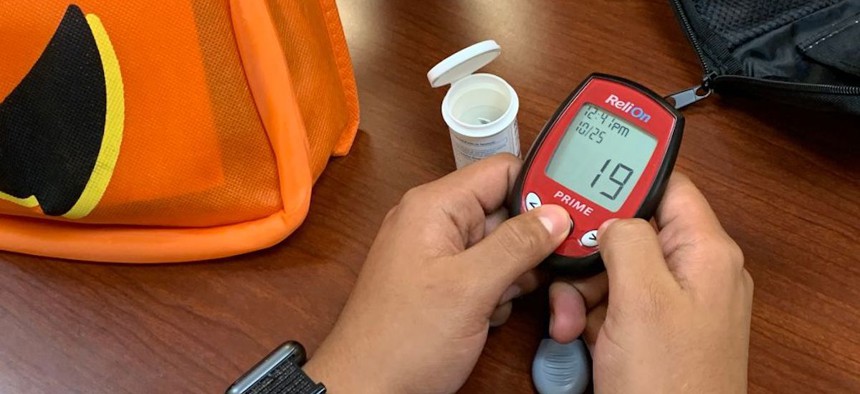

A migrant without legal permanent status learns how to use a glucometer at Children's National Hospital in Washington, D.C., on Oct. 25, 2019. A group of health care providers established a health clinic for children, particularly those with diabetes, who may not otherwise have access to health care due to their immigration status Marvin Joseph/The Washington Post via Getty Images

By increasing access to health insurance, including for immigrants lacking permanent legal status, states can reduce the burden of health care costs for communities.

Immigrants face many challenges, including learning a new language, getting a job and a place to live and accessing affordable health care. And while noncitizens only make up 8% of the U.S. population, they constitute about 32% of the population without health insurance. A lack of health coverage can create financial ills for immigrants and their communities, which some states are trying to remedy.

This year, Colorado announced OmniSalud, a state-based subsidized health insurance program for immigrants living in the U.S. without legal permission. It aims to remove barriers to affordable health care, according to Laura Mortimer, the reinsurance director at the state’s Division of Insurance. State subsidies go to insurance providers, who then offer beneficiaries zero- or low-cost premiums for health insurance policies.

The program, which gives previously uninsured individuals access to services like yearly checkups, immunizations, maternity care, diabetic supplies, and mental and behavioral health care, has proved immensely popular. Mortimer said applicants flocked to the enrollment platform Colorado Connect, but due to budget limitations, only 10,000 enrollees were accepted for 2023.

By subsidizing health insurance for noncitizens, Colorado can not only reduce the number of uninsured individuals, but also minimize taxpayers’ burden for uncompensated care, Mortimer said. Anyone who goes to an emergency room, for instance, will receive care, whether they can pay for treatment or not, but the tab is often picked up by taxpayers. In 2017, for instance, uncompensated care was estimated to cost state and local governments $11.9 billion nationwide, researchers estimate.

Colorado’s subsidized health insurance plan can also help stabilize the state’s insurance market, said Vincent Pohl, senior researcher at Mathematica, a research and policy consultant for state governments. As immigrants enroll in OmniSalud, there are more individuals that insurance companies can cover, and thus receive state subsidies for.

Plus, expanded health coverage for the public can help keep hospitals financially solvent, said Lee Che P. Leong, a senior policy advocate at Northwest Health Law Advocates, a health consumer advocacy group. In fact, from July 2021 to June 2022, rural hospitals in states without expanded Medicaid had a median operating margin of -0.7%, while rural hospitals in states that did expand Medicaid coverage had a median operating margin of 1.2%, according to a KFF analysis earlier this year.

OmniSalud will offer coverage for 2024 and will accept an additional 1,000 enrollees, Mortimer said. While it is still too early to analyze the effectiveness of the program, the Division of Insurance will leverage enrollment and claims data to determine how beneficiaries are using their health plans. That data will help inform program improvements to better meet the community’s needs, she said.

For immigrants living in the U.S. illegally, having access to health insurance can stabilize their finances, Leong said. With access to regular care, individuals may be more likely to seek free or low-cost preventative care instead of waiting until a health condition requires extensive—and expensive—treatment. Those last minute remedies can create cascading financial burdens on patients and their families, she said. For instance, without affordable health coverage, individuals risk accruing medical debt, which has historically impacted people’s credit scores.

Washington state is also trying to expand health coverage for noncitizens. Earlier this month, the Evergreen State became the first in the nation to allow residents, regardless of immigration status, to purchase health coverage through Washington Healthplanfinder, the state’s online health exchange where individuals can compare and choose health insurance plans. Individuals can now enroll in one plan for 2024 with a single family deductible even if family members have different immigrant statuses, according to the Northwest Health Law Advocates.

But Washington isn’t stopping there, Leong said, as the state recognized there are still uninsured residents who may need additional financial assistance for health coverage. To fill that coverage gap, next July the state plans to launch a “Medicaid-like” program to offer free health coverage for noncitizens with an income up to 138% of the federal poverty level, she said.

The program was allotted $49.5 million in the state’s budget, but Leong said that funding will only cover a fraction of the residents estimated to be eligible for it. State agencies and stakeholders are still developing plans for implementation.

Elsewhere, California passed legislation to expand health coverage for immigrants living in the state illegally in 2021, and last year officials said about 286,000 adult immigrants were insured by the state’s health coverage program Medi-Cal. Illinois has also made efforts to insure noncitizens, but Gov. J.B. Pritzker announced in June that enrollment to its state-based health insurance program will be paused due to budget negotiations.